Written by: Anna Courtney

What is ADP?

ADP, stands for Automatic Data Processing, which is a provider of human resources management software and services worldwide. ADP is one of the largest and well known providers for HR solutions. The company provides software and services for a wide variety of human resource management and payroll needs.

Development

ADP (Automatic Data Processing) was founded in 1949 as a small payroll processor and has grown into a global human resources company, one of the world’s largest providers of human capital management solutions. ADP was among the first of what has been defined more recently as the HR-tech industry. Early on that meant advancing from having clerical staff produce payroll services by hand to the use of electronic data processing machines in the 1950s, then to the internet in the 1990s, and more recently to a service delivered by cloud computing and mobile apps.

ADP moved into the Professional Employer Organization (PEO) space to provide broad-based outsourced HR solutions. Today, ADP is known as an innovator in the HR and payroll services industry, seeking to strike the right balance between technology and the human touch in its services.

We will take a closer look at what the platform has to offer in this ADP Payroll Review 2024.

Pros

✅ ADP offers a wide array of services, including automated payroll processing and tax filing, HR management, benefits administration, and compliance support, making it a one-stop solution for many businesses.

✅ The platform is scalable, catering to the needs of both small businesses and large corporations. This flexibility allows companies to use ADP’s services as they grow.

✅ ADP is known for its intuitive and user-friendly interface, which makes payroll and HR tasks simpler for administrators and employees.

✅ The platform can integrate with various business systems and applications, enhancing its utility and ensuring smooth operations across different business functions.

✅ ADP supports multi-country payroll and HR services, which is beneficial for companies with a global workforce.

✅ ADP places a strong emphasis on data security and regulatory compliance, helping businesses protect sensitive information and adhere to various legal requirements.

✅ Offers custom plan

Cons

❌ ADP’s comprehensive services can be expensive, particularly for small businesses

❌ While ADP offers many features, smaller businesses might find the platform more complex than needed for their operations.

❌ Some users report mixed experiences with customer service, ranging from highly responsive to delays in resolving issues.

❌ New users may face a learning curve in navigating the extensive features and capabilities of the platform.

❌ No free trial

❌ The pricing structure may be complex, and some features come at an additional cost.

Product Specifications

- Payroll Processing:

- Automated payroll processing

- Direct deposit and paper check options

- Tax filing and payments

- Customizable payroll reports

- Human Resources Management:

- Employee database management

- Hiring and onboarding tools

- Time and attendance tracking

- Performance management systems

- Benefits Administration:

- Health insurance management

- Retirement plan management

- Compliance with ACA and other regulations

- Compliance:

- Employment laws and regulations updates

- Labor law poster compliance

- EEOC and OSHA compliance support

- Technology and Integration:

- Cloud-based platform accessible from anywhere

- Mobile app for employees and employers

- Integration with other business software (e.g., accounting, time tracking)

- Data Security and Privacy:

- Encryption and secure data storage

- Multi-factor authentication

- Compliance with data protection regulations

- Support and Customer Service:

- 24/7 customer support

- Dedicated account manager

- Online resources and training

- Additional Services:

- HR consulting and advisory services

- Talent management and recruitment tools

- Employee financial wellness programs

These features represent a broad overview and might differ or include more specific functionalities depending on the exact ADP product or package your business chooses.

Pricing and Plans

ADP has omitted standardized pricing and plans from its website. The company says this is because it offers so many services that can be customized to meet individual businesses needs; that pricing is tied to factors such as the company’s size, the types and number of services it needs, and the complexity of the payroll and HR system the business is trying to manage.

ADP offers a range of plans tailored to meet the unique needs of businesses of different sizes. Their services are segmented primarily into three categories: small business (1-49 employees), midsize business (50-999 employees), and large business (1000+ employees). Here’s an overview of what each category includes:

Essential Payroll: $59/month plus $4 per month, per employee The Essential Payroll plan from ADP is the simplest of the company’s online payroll solutions. This plan is primarily meant for small business owners that are looking for an out-of-the-box solution meant to handle basic payroll processing needs. Features of the Essential Payroll plan include auto payroll processing, employee direct deposit and comprehensive tax filing automation to ensure tax compliance with the various tax authorities. The plan also includes useful new hire reporting compliance feature. Essential Payroll is a great solution for business owners who just need a simple, highly functional payroll tool without access to advanced HR services.

Enhanced Payroll: The Enhanced Payroll plan ranges from $109 per month. It has also $4 per user extra charge per month. Its features builds upon the Essential Payroll plan. The main difference is that it is constructed for an enterprise that needs more than just the basic payroll services.

With the Enhanced Payroll plan, businesses get extra HR services such as help with onboarding employees and background checks, and they might find this service beneficial as they ramp up their service offerings and grow their teams.

Complete Payroll and HR:

The cost of the Complete Payroll and HR plan is dependent upon your company’s unique needs and varies according to the features and services desired. You can call ADP for a quote.

The Complete Payroll and HR is a full solution that is ideal for businesses who want an inclusionary package offering extensive payroll services with more advanced human resources management tools than most of its competitors.

Notable features of the plan include a robust compliance-management tool and resources to help with workers’ classification issues under employment laws and regulations, employee benefits administration (eg, health insurance and retirement plans) and talent management (eg, tools to hire, manage and develop employees).

The plan provides companies with the opportunity to not only conduct themselves according to strict recruiting and HR practices, while also staying compliant with laws, but also offer a range of employee benefits.

HR Pro Payroll: This plan is also customized according to the needs of each business and it’s mainly designed for companies that need very customized or sophisticated HR management. It includes everything in the Complete package and more HR support.

Key features

Payroll Processing

ADP’s payroll processing system helps companies manage payroll efficiently by automating the multitude of processes involved in employee compensation, including automated calculations, tax deduction and filing, variety of payment methods, and records management. Through automated calculations, each employee’s pay is computed using precise information on hours worked, salary rates and overpayments such as bonuses and overtime.

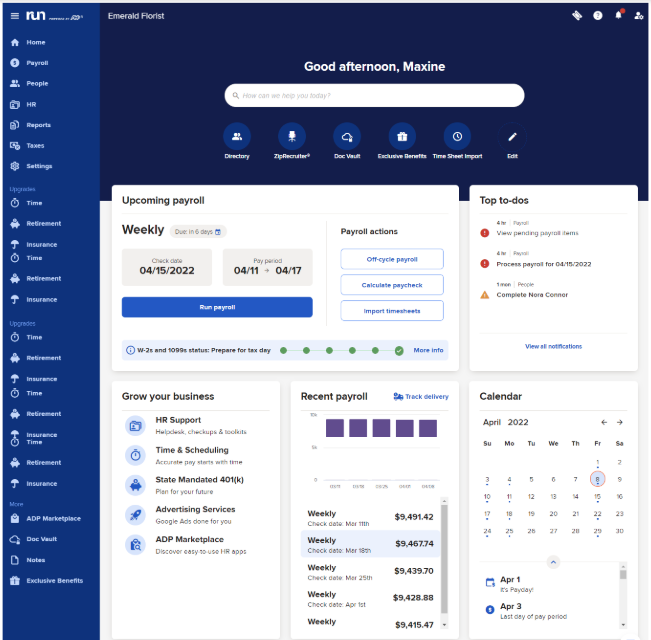

ADP “RUN” is designed specifically for small businesses, offering straightforward payroll, tax, and HR services that are easy to use, with a focus on simplicity and efficiency.

The Home page in “RUN” enables you to manage payrolls and review payroll tasks and messages (Source: ADP)

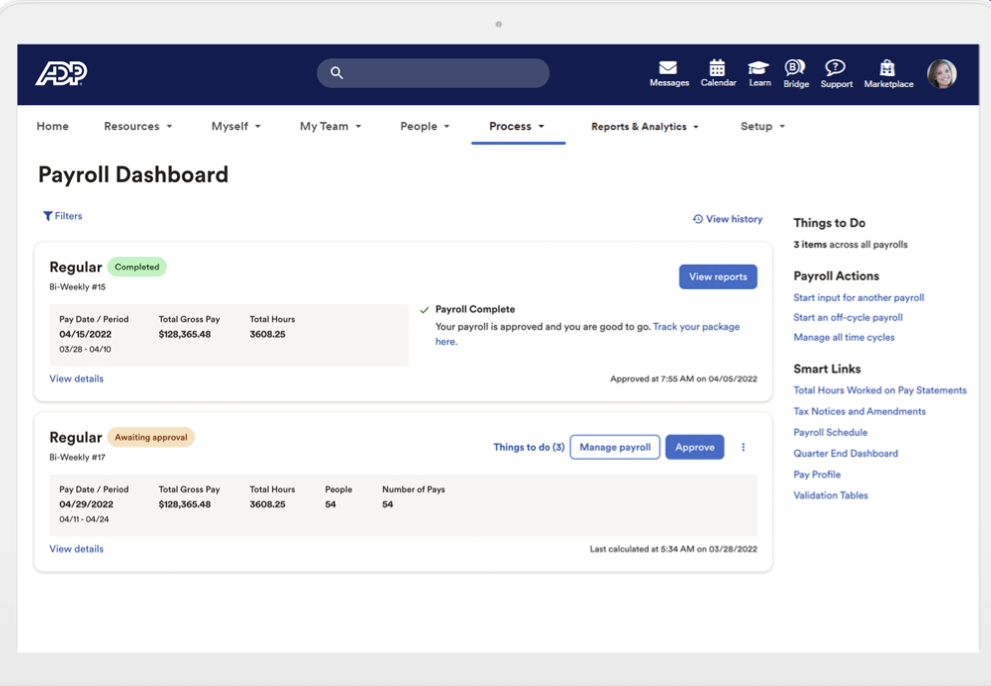

ADP Workforce Now, aimed at mid-size to large businesses, offers a more complete package of HR management features, including more sophisticated payroll, HR, benefits administration and talent management solutions. The primary differentiation between the two is the size of the business they are targeting, and the sophistication of features they are offering.

Ease of Use

It is an easy to use platform with user friendly UI. ADP is streamlining the usability with an interface that’s intuitive. This gives way to better navigation and task delegation with the varied HR functionalities it provides. Available anywhere with desktop and mobile access.

The Payroll dashboard, here with an overview over completed payroll and the ones awaiting approval (Source: ADP)

The ‘Run and Done’ feature automatically performs payroll processing based on predefined conditions, enabling employers to avoid manually making payroll setup for each payroll period. Ideal for small to medium–size firms with fixed payroll arrangements, it provides employees with timeous and accurate payment, and frees up more man-hours for other business tasks.

Tax Compliance

To satisfy tax obligations the platform also withholds the appropriate federal, state and local taxes from each paycheck and makes the requisite tax filings and payments for each worker on an ongoing basis.

ADP produces W-2 and 1099 forms for employees, and also submits these to the IRS for you. Employees can access the forms through the employee self-service application.

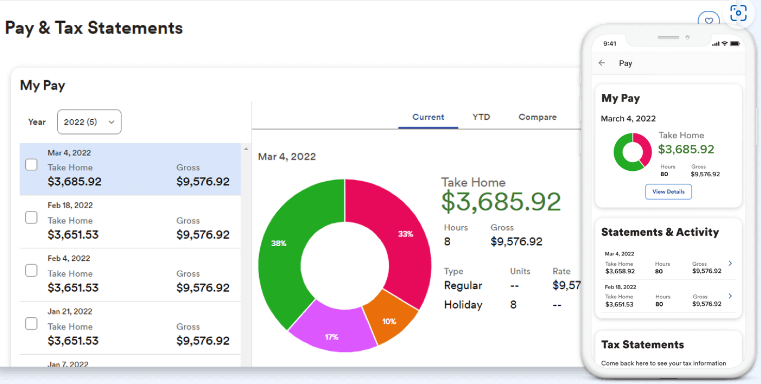

Employers can pay employees in three ways through direct deposit (where a daily transfer is sent to a participating bank account), paper check or pay cards. The system can also generate employee payroll records to keep track of an employee’s pay history, including specific deductions due to taxes. Legal compliance doesn’t only have to do with the specific language that is used in an employment contract, but also with having a solid record on your behalf.

Employees have easy access to pay, time and benefits via desktop or mobile (Source: ADP)

Payroll Reporting and Analytics

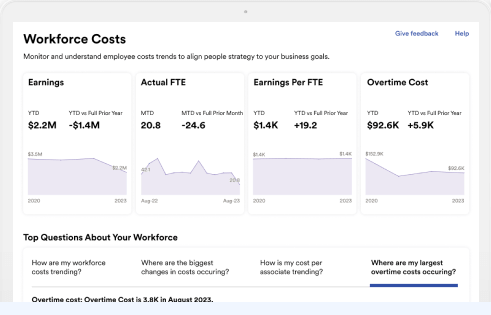

ADP payroll reporting and analytics gives companies a comprehensive and sophisticated look at how they are running payroll and managing finances. It is full of different features and customizable to fit the needs of any company. It includes a full suite of reports which breaks down details of payroll summaries and tax deductions, employee earnings and benefits contributions. These features are invaluable to a company who wants to manage their payroll expenses and maintain sound financial status.

The platform gives a good overview over key metrics like workforce costs, which you can find under the “report and analytics” drop down menu (Source: ADP)

Graphs and charts are built into the dashboard to allow you to visualize data, and ADP gives you access to historical payroll records as well.

In addition to accurately reporting on payroll activity, ADP sends real-time analytics back to companies so they can look at their payroll data as it’s happening, which is vitally important in spotting trends, doing period-to-period comparisons and looking at payroll’s affect on the bigger whole of the organization’s finances. It’s also customizable. People can look at their dashboards and ask what’s my specific company doing today? What’s my area of expertise? Who do I need to keep my eye on?

Compliance reporting is another key component of ADP’s reporting and analytics, allowing firms to generate reports that must be filed for tax and payroll compliance, assisting firms in staying within the bounds of the law, and able to withstand scrutiny from inspectors or auditors.

Its reporting and analytics tools can integrate with other business systems such as your accounting software, or HR management systems. The insights are always available to you via ADP’s online portal or mobile applications.

Employee Self Service Portal

ADP’s Employee Self-Service (ESS) Portal is one of the important components which plays a contributory role in the broader scope of HR activities and can be the backbone of any business house. This online portal provides an avenue for employees to take control of aspects of their employment and personal information on their own.

Through the portal, employees can check their pay stubs and payroll history, providing a clear and easy to follow information of their payroll.

Furthermore, through its ESS Portal, the ESS makes it extremely easy for employees to update their personal data, such as contact details and emergency contacts whenever needed, to make sure that they are always updated.

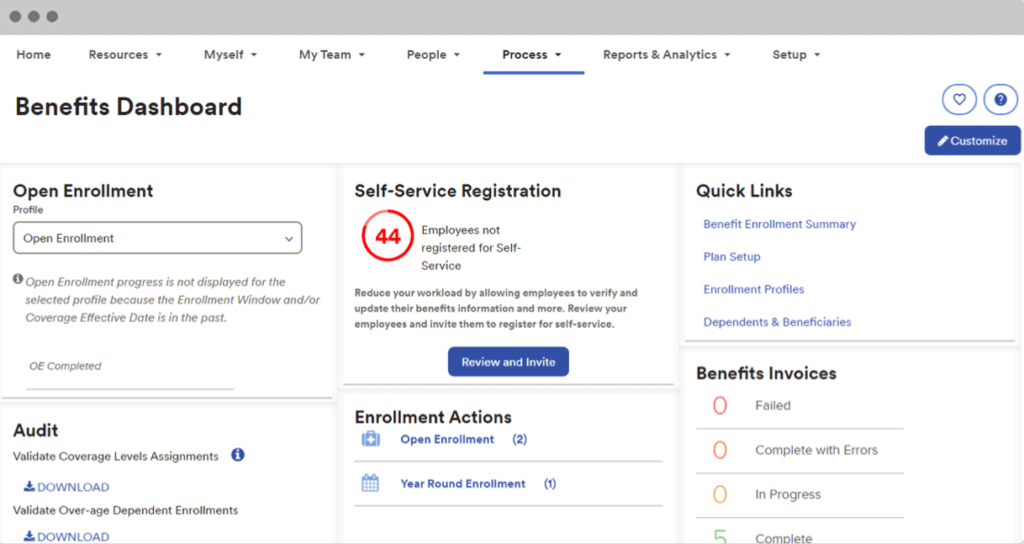

It also is a single location where employees can go to either look at their current benefits, make changes to their benefits during open enrollment, or change information following a life event.

Benefits dashboard (Source: ADP)

The portal is also geared to help with tax information management, enabling employees to view and update their tax withholdings and access W-2 forms and other vital tax documents. For organizations that pair it with ADP’s time and attendance system, employees can also use the portal to check their work hours, maintain schedules, and request leave.

ADP’s portal is available on both browsers and mobile apps, enabling you to check in anytime, anywhere. In addition to fasilitating easy access, ADP maintains stringent privacy and security policies for the personal information of its clients, ensuring a secure environment and complying with applicable privacy laws and rules.

Time and Attendance

ADP time and attendance is an add-on for streamlining employee hours, and making sure that payroll is timely and accurate. ADP promises flexibility in how employees punch in and out, with options that include web, mobile apps and physical clocks, and makes sure that the data gets integrated with payroll, fulfills labour laws and provides features such as scheduling, leave and request management, and real-time monitoring.

The employers can get their pick among set rules, various notifications for missed punches and or overtime, and employees can have self-service for things such as viewing their schedules and requesting time off, which helps in ease of operation while improving compliance and workforce management insights.

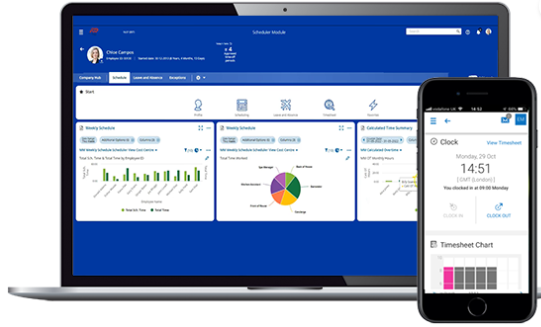

What is ADP Realtime?

ADP Real Time is a cloud-based solution that offers a simple yet sophisticated way to manage time, attendance and payroll for businesses with anywhere from 50 to 10,000 employees, from any device. The benefit of the system is that employees get paid on time, every time, for the work that they have done, thus reducing the likelihood of dissatisfaction and turnover. Operational efficiency improves, as hours data is clear and visible, assisting businesses with overtime and the effective management of their operations.

ADP Realtime Dashboard on pc and mobile (Source: ADP)

Automated time tracking eliminates mistakes and dishonest behavior (eg, time theft), reduces documentation tasks associated with leave or overtime, assists in ensuring that employment laws are adhered to, and complies with the laws related to wages, holidays and time off.

Among this product’s notable features are the reductions in administrative tasks, enhanced system security by paying through one system and keeping employee information in a single payroll system, as well as a reduction in human errors, especially for end-of-month accounting and compensation of careers with intricate compensation plans. ADP also facilitates the accuracy of attendance compared to manual schedules by building HR, payroll and time attendance systems.

It does surpass competitors with its extensive reporting capabilities and it also integrates seamlessly with HR systems to save time.

Integrations

ADP’s platform has especially deep integration capabilities. If you use their products, you can streamline your company’s workflows, centralize data, and free up resources for higher-value tasks.

Its platform can integrate with a wide range of core business systems and automate activities related to all aspects of payroll, human resources, time tracking, financial management, employee onboarding, benefits and much else besides. ADP connects with the leading accounting software packages including QuickBooks, Xero and Sage for payroll processing and financial reporting, and time tracking integrations with TSheets and ClockShark.

For recruitment and onboarding, ADP can connect with LinkedIn and Glassdoor to simplify hiring processes. It can integrate with benefits providers for benefits administration management, and it can connect to productivity tools such as Slack and Microsoft Teams for team collaboration.

Setup

The ADP setup process for payroll solutions, HR and tax compliance solutions, benefits administration and other services, will take several days for a payroll solution to a few months for a full-scale HR solution (this is broad but applies to most companies) depending on how complex your needs are and the level of data readiness. Your payroll needs might be urgent so this is worth noting.

The process starts with a needs assessment to understand your business size and requirements to determine the appropriate ADP services. In the next step of the process you will (1) migrate employee data, (2) migrate payroll history, and (3) migrate payroll rules to the ADP platform: Once the data is transferred from the client to ADP, and it has been checked and adjusted for errors a new payroll can be designed.

There are several crucial points for supporting accurate payroll and HR management. Employees must be classified appropriately in the payroll system. Second, the quality of the data migrated from a legacy payroll system or obtained from employee self-service must be high to ensure accurate calculations and management.

A big part of the setup is to train your employees to use the ADP system effectively, following the in-app tutorials and guided webinars. ADP will also provide customer service and support post-setup. As part of this process, an account manager might be assigned to you for liaising, while the larger customer support team would be your go-to experts whenever there are any questions or problems that might come up during the operations phase.

Customer Service

ADP provides support through phone, email, live chat and a huge knowledge base filled with tutorials and webinars to help promote self-help and increase user knowledge.

For newly onboarded clients, ADP goes through an intensive training program focusing on maximizing the platform’s benefits. ADP also provides support to large and multinational corporations looking to merge IT systems for a global workforce.

Ratings from some of the biggest review sites

Capterra gives ADP the following score 4.4/5 (based on 6393 reviews)

G2 gives ADP the following score 4.1/5 (based on 3366 reviews)

Consumer Affairs gives ADP the following score 4.2/5 (based on 2251 reviews)

Awards and Recognition from the Industry

(Source: ADP)

(Source: ADP)

Who would be a good fit for ADP?

- Expanding businesses needing comprehensive HR support, including compliance, payroll, benefits administration.

- Companies seeking robust payroll services, with efficient management of payroll taxes and a filing error guarantee.

- Organizations looking for HR and payroll integration, with capabilities to integrate with various third-party applications.

- Businesses requiring a wide range of employee benefits, risk management, and legal compliance support.

Considerations before choosing ADP TotalSource:

- Potential concerns about customer service quality, with reports of poor customer support and technical assistance.

- The complexity of the system and its cost, including a long and complex setup process and a higher-than-average price point.

- Mixed user experiences, with some users finding the platform glitchy and difficult to navigate.

Its important to evaluate these aspects before considering choosing ADP as your PEO. You can also consult with a representative or request a demo on their website to see if ADP TotalSource aligns with your business specific requirements.

Who would not be a good fit for ADP?

- Small businesses with very tight budgets that find ADP’s pricing too high.

- Businesses that prefer a more hands-on approach to payroll and HR without relying on external support.

- Startups needing flexible, scalable solutions that can easily adapt to rapid changes in size and structure.

- Organizations that prefer open-source platforms or highly integratable ones that can link with a broader portfolio of third-party apps and services outside of ADP’s app marketplace.

- Businesses in areas where ADP does not provide locally-specified service features or technical support.

- Who prioritize ultra-responsive, personalized customer support.

Conclusion

ADP provides integrated solutions designed for medium and large businesses and those with specialized industry needs or a global workforce. ADP is consistently listed among the top five payroll providers. ADP is a good choice if you want a highly specialized HR/payroll solution that is integrated with other software provided by the vendor.

However, it could be less suited to the smallest businesses, those on a limited budget, and the companies requiring bespoke options. If your needs are basic or your company has expert in-house HR staff, ADP’s services could be overkill.

If you want enterprise-level HR services, and efficiency, compliance and security are your primary goals and if your company size is large enough to make that worthwhile, then ADP is a great choice. If instead you are a small business or you are looking for something more simple and cost-effective, try looking elsewhere. But if you need to handle employees and do so well, you should first meet with a representative from ADP and see whether bringing them onboard will help your business achieve its goals.

If you are not sure if ADP TotalSource is the right fit for your company, check out its close competitor Justworks in our review here