Written by: Tom Smith

Introduction

Most people know Gusto through its cloud-based payroll, benefits and human resource management software. Gusto offers an all-in-one software solution designed for complex payroll, benefits and HR needs, particularly for small- to medium-sized businesses. The Gusto platform allows companies to automate time-consuming tasks and, through its human support, reduce errors. In this Gusto 2024 review we will look at the pros, cons, pricing and key features of the payroll solution.

Development of Gusto

It was founded in 2011 by Joshua Reeves, Edward Kim and Tomer London, and known variously as ZenPayroll and now as Gusto. Payroll processes have since been joined by benefits and HR services, both in terms of providing them to the firm’s thousands of smaller business clients, and in research and development. This change in focus led to the rebranding, from the ‘ZenPayroll’ of 2014 to ‘Gusto’ in 2015.

Since then, Gusto has undergone many changes, becoming an all-in-one HR service offering not only employee payments and tax compliance but also health insurance processing and 401(k) retirement planning, among other administrative services such as employee onboarding and workplace management. The company’s values of automation, compliance and simplicity have helped it build one of the largest customer bases for this kind of software among small- and medium-sized businesses. Its focus has helped Gusto grow from a scrappy startup to a company worth $3.1 billion at its last valuation in 2021.

Pros of Gusto

✅ An intuitive and user-friendly design, making payroll and HR tasks manageable for users without extensive experience in these areas.

✅ Providing full service payroll (unlimited pay runs), tax filing and payment services, benefits administration, and HR tools.

✅ Gusto automates the filing of taxes and doing payroll, which decreases the likelihood of a human error as time is also saved.

✅ It will maintain itself in accordance with changing tax law and regulations, and it will ensure that businesses remain in compliance with all tax laws – a boon to the countless small businesses that do not have an HR department or benefit department.

✅ Gusto offers extensive customer service that’s accessible across numerous support channels and user resources so that you can get the most out of the platform.

✅ It works seamlessly with other business software and tools, making workflow and handling data easier.

✅ Targeted primarily toward small- and medium-businesses. Works particularly well for companies with fewer than 50 full-time employees.

✅ Handles international contractor payment in 120+ countries

Cons of Gusto

❌ Some users report that while Gusto is great for standard HR and payroll needs, it may lack advanced customization options for more specific or complex requirements.

❌ Gusto is not a good fit for larger enterprises with more complex HCM needs.

❌ The range of benefits offered, such as health insurance, may be limited in some states (US), which can be a constraint for businesses with employees in those areas.

❌ While generally user-friendly, for some users there could be a learning curve, more so with more complicated HR functions.

❌ Although Gusto is known for good customer support, during peak times, some users have reported delays or challenges in getting timely assistance.

Pricing and plans

Contractor Plan:

- This plan is specifically designed for businesses that only pay contractors. You can get a discounted base price of $0/mo for 6 months, and you pay $6 per employee per month. This plan includes features like unlimited contractor payments, 1099-NEC filings, 4 day direct deposit and new hire reporting. International contractor payments can also be added.

Simple Plan:

- The Simple Plan is designed for small businesses with basic needs in payroll and hiring support. The Simple Plan includes full-service single-state payroll with quarterly tax filings, unlimited hr support, hiring and onboarding tools, and health insurance administration, plus employee financial benefits, unlimited payroll and time-off reports, basic customer support, and a dedicated account manager. Monthly costs for the Simple Plan are $40 a month and $6/employee/month.

Plus Plan:

- This plan is an expansion of the Simple plan, providing everything in it, with additional features including multistate payroll, next-day direct deposit, advanced hiring and onboarding tools, PTO management, time an project tracking, and extended customer support hours. The monthly cost for this plan is $60, with an added fee of $9 per employee per month. Priority support and HR resources are an option on this plan that add an additional +$8/month per employee.

Premium Plan:

- The Premium Plan has all the features of the above plans, plus a lot more—an HR resource centre, compliance alerts, certified HR experts and trusted customer support. It’s suitable for scaling payroll and benefits and with certified HR experts, priority support and your dedicated success liaison to get you going on the right track for success. The Gusto Premium plan is custom-priced based on your business needs. You just have to reach out to Gusto to know how much it costs.

Additional Services:

- And Gusto also offers optional benefits, such as workers’ compensation insurance, health insurance, broker integration, 401(k) retirement savings plans, and life and disability insurance, among others at an additional cost.

Gusto does periodically run promotions, such as waiving certain fees for the first few months or offering introductory discounts on monthly or annual fees when you sign up early. Prices and features do also change over time, so if you’re debating whether to use Gusto, I encourage you to check Gusto’s website or contact a sales team member to get the most up-to-date pricing and details about different plans and features so you can choose which one is right for your business.

Key Features of Gusto

- Automated payroll processing, handling tax calculations and filings to ensure accuracy and compliance.

- An employee self-service portal where employees can access pay stubs, tax forms, and update personal information.

- Simplified management of benefits like health insurance, 401(k) plans, and various employee perks.

- Essential HR tools for efficient onboarding, time tracking, and managing employee records.

- Support for staying compliant with state and federal regulations, including features like new hire reporting and compliance checklists.

- Seamless integration with popular accounting software such as QuickBooks, Xero, and FreshBooks.

- Automatic calculation, filing, and payment of local, state, and federal payroll taxes.

- Robust customer support, including access to HR professionals for advice on complex issues.

Payroll processing

Gusto can automatically complete your payroll runs once a week, twice a month, semi-monthly or monthly to ensure that your team gets paid on time and without any issues. The consistent nature of these runs will hugely benefit salaried employees, generally the majority of your team.

Key features of Payroll:

- Automatic payroll runs.

- Direct deposit and check options.

- Payroll tax calculation and filing.

- Year-end W-2 and 1099 forms processing.

- Unlimited payroll runs in all 50 states (US)

Understanding Payroll Processing with Gusto

The journey begins with the initialization, when the company and its employees go into Gusto and enter their information – salaries or hourly rates, work schedules, etc. Whatever’s entered there will be the baseline for every payroll run from then on.

Gusto tells you exactly how much you should pay your employees at the end of every pay period, based on their salary or hourly rate, and by adding extra earnings (bonuses, etc) and subtracting deductions (taxes, insurance, etc). For hourly employees, the system also factors in the number of hours worked, including overtime, which your employees can log themselves via the Gusto app. For the salaried employees, Gusto gives them consistent paychecks based on their yearly salary.

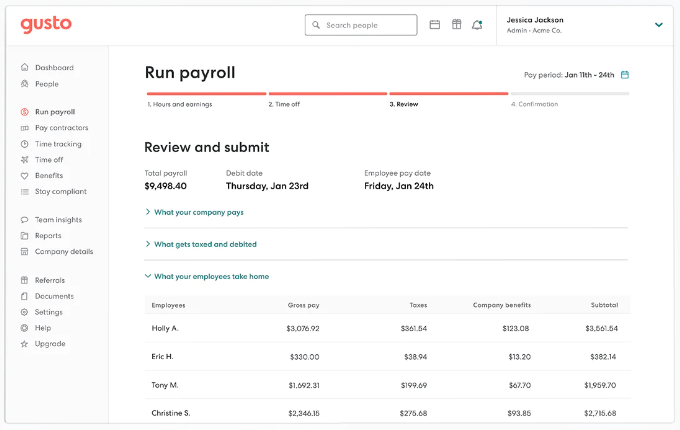

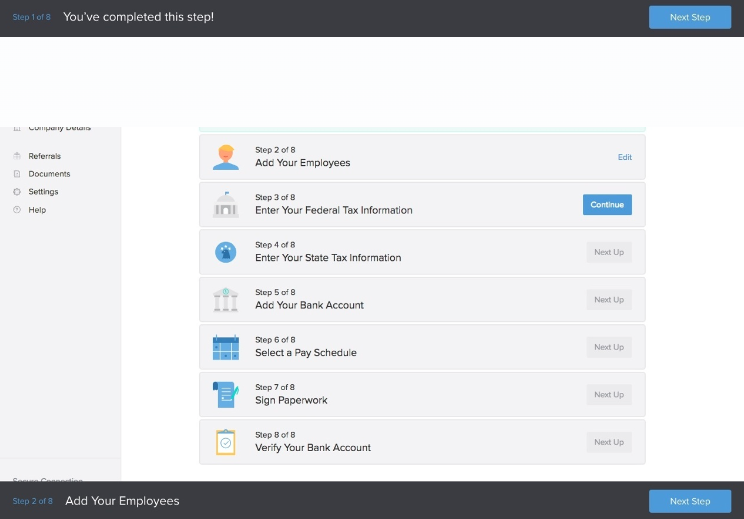

Its features are easy to learn and you can run payroll quickly (Source: Gusto)

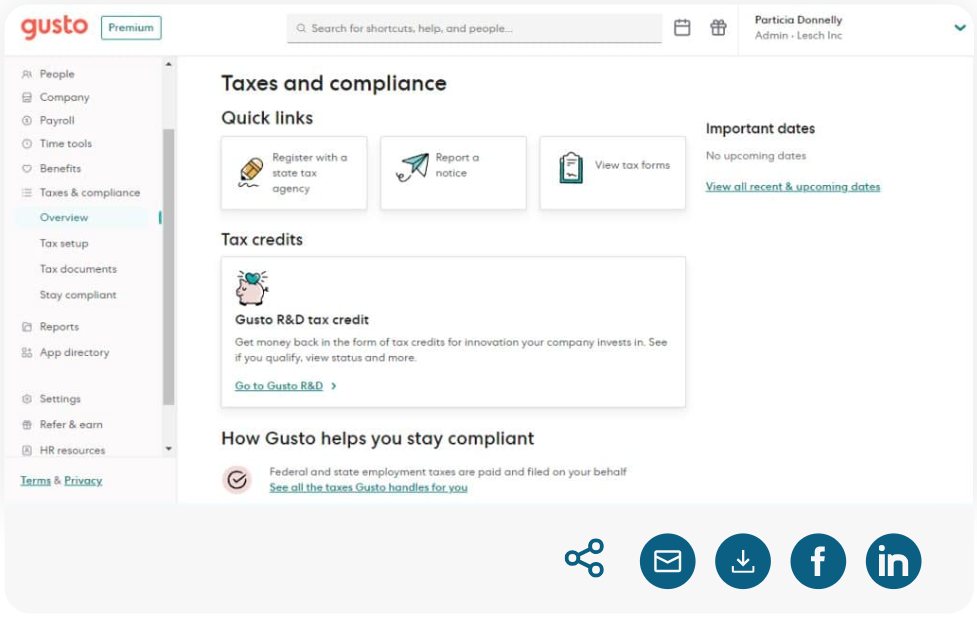

Taxes. Undoubtedly, the most important function of Gusto’s payroll service is handling taxes. With each employee, Gusto automatically determines exactly how much they owe in federal, state, and local taxes for each pay period, which could also include withholding for income tax, Social Security, and Medicare. Gusto also updates the relevant tax tables in order to file these taxes with the appropriate government agencies every year – saving immeasurable amounts of time for businesses that would otherwise have to crunch their own numbers and risk making an error.

Taxes and compliance, with useful links (Source: Gusto)

Employees then receive their pay, deposited directly via direct deposit (as most employees set up with a choice from various banks) and with their pay stub available through an online portal with a click of a button. The pay stub details out earnings, taxes withheld, and all other mandatory or optional deductions or contributions.

At the end of the year, Gusto also takes care of your tax forms for you. It prepares and sends out W-2 and 1099 tax documents (important tax documents for employees and contractors) accurately and on time.

Even though it is highly automated, Gusto delivers organizational flexibility. An employer controls how often they want to run payroll, and has the ability to run off-cycle payrolls, such as bonus payments or fixes to a payroll (like restoring overtime pay forgotten in a previous run). It also allows for late changes and tweaks to reflect corrected compensation before the run is finalized.

A detailed history is always recorded by Gusto on all payroll activities. Such an essential feature helps with business financial planning, audits and compliance. The platform offers various reports, giving businesses insights into their payroll expenses and trends, which can be instrumental for strategic decision-making.

Benefits administration

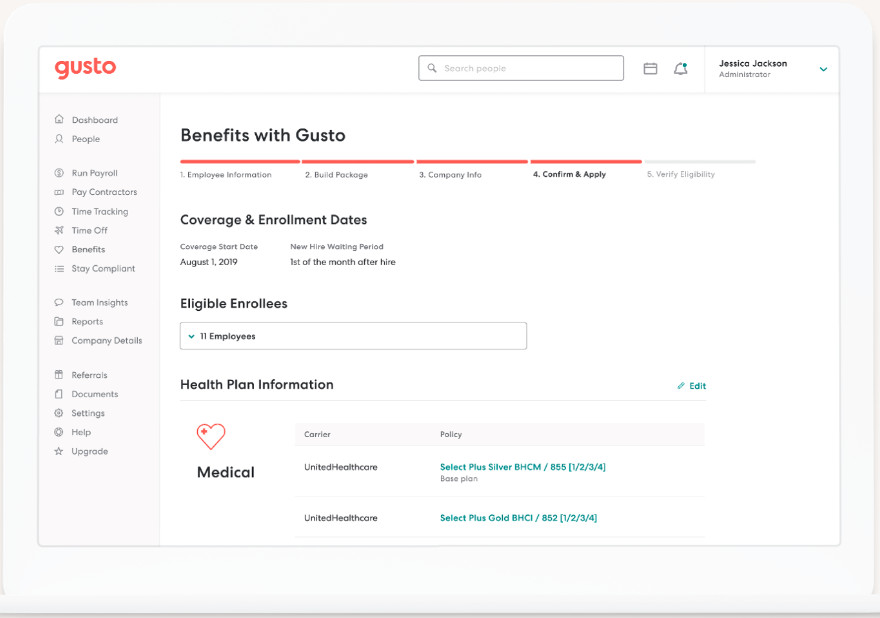

How Gusto manages employee benefits is a key component of their platform, making it easy to both administer benefits and offer a lot of them. Gusto offers companies a lot of different ways to care about their workers. They include health insurance that covers a network of medical, dental and/or vision plans; retirement savings accounts such as 401(k)s; as well as flex spending plans, health savings accounts, and commuter benefits.

One of the company’s notable features is how it integrates benefits administration with the payroll system: ‘When you activate benefits, Gusto does the math for your employees’ benefits deductions automatically, and the right amount is automatically withheld from direct deposit each pay period.

Gusto serves as a key partner in selecting a health insurance plan for organizations and employees. Gusto helps employers choose and enroll in a plan, it ensures the selected health insurance is optimally integrated in the payroll system for easy ongoing payment management, and assists with the required paperwork and compliance.

(Source: Gusto)

Gusto’s retirement plan feature provides an easy way for a business to set up and run a 401(k) plan, providing employees with automatic paycheck deductions and employer match (if applicable) and supporting compliance with retirement plan regulations. This makes it easier than it might be to offer employees a 401(k) plan.

It doesn’t stop there either. Employees have access to a self-service experience where they can easily view potential benefits, obtain a quote and view current plans online, and manage their contributions. This self-service feature empowers employees to take control of their benefits and reduces the administrative burden on the employer

Moreover, Gusto actually tracks a lot of benefit admin compliance stuff – such as reporting features to meet Affordable Care Act (ACA) requirements for health insurance and so on. That, in turn, helps businesses make sure that they are not only compliant with federal reporting requirements but also updated on state compliance requirements.

In summary, Gusto’s benefits administration feature stands out for its comprehensive management of various employee benefits, integration with payroll for ease of deductions, assistance in plan selection and compliance, and the empowerment of employees through self-service portals.

Onboarding Key features

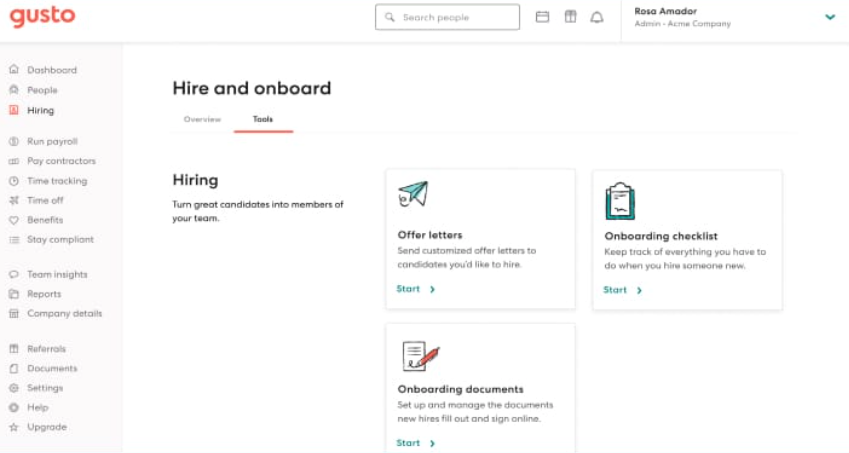

What makes Gusto’s onboarding stand out is the use of digital technology to re-imagine what it means for new hires to join a company. The very first step in onboarding is for employers to send new hires digital letters of offer and other forms that need to be completed and signed as part of the onboarding process.

Gusto presents these forms online, where new hires can view and sign the documents with a couple of clicks. Beyond digital record-keeping, Gusto also embraces the value of compliance, which is written into its software to make sure that employees receive the forms that they are entitled to, such as I-9 and W-4 documents.

When entering these forms into the system, both have fields to be completed and signed off on that are automatically checked to ensure that all required steps are completed before hiring the employee. For employers, these automatic checks greatly reduce the complexity of being compliant with employment regulations.

(Source: Gusto)

The onboarding checklist consisting of 8 steps is easy to follow (Source: Gusto)

One of the key features about Gusto’s onboarding process is the Employee Self-Service Portal. With the Employee Self-Service Portal, new hires get to be in the driver’s seat of their onboarding process. New hires can enter their own personal information, set up direct deposit for their paychecks, and access policies such as their employee handbook.

Moreover, Gusto has the capacity to merge onboarding information into payroll and benefits administration systems. If a new hire includes their personal and financial information for Gusto’s onboarding portal, this information will be transferred into their payroll record. This minimizes inconsistencies between HR platforms by eliminating the need to manually re-enter the data, and all of Gusto’s records with regard to the employee’s information will be the same.

Time tracking and PTO management

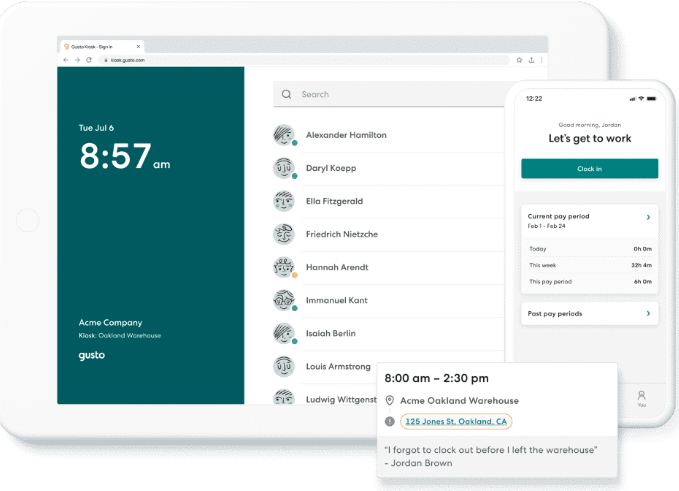

Gusto provides a package which includes time tracking that synchronizes with payroll functions and provides administrative controls for managers to oversee staff work hours and grant time off. The platform also supports certain types of employee products. Employees log their hours using Gusto, breaking up their time between regular hours and overtime, as well as multiple other time categories. They log their work hours directly from either their computer or mobile device.

(Source: Gusto)

Gusto’s time tracking system is combined with its payroll system, so the hours an employee has worked are automatically imported into payroll, ensuring that wages will be calculated correctly. This feature benefits hourly employees in particular because it ensures that they will be paid at their regular hourly wage.

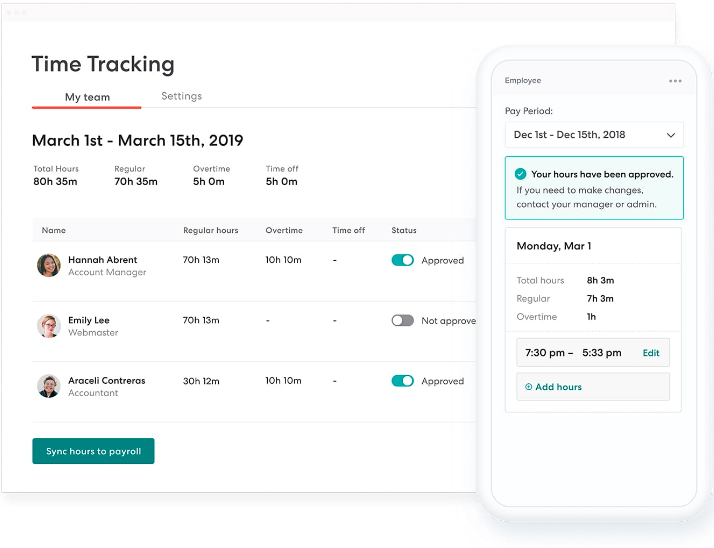

The time tracking tool lets you easily sync hours to payroll (Source: Gusto)

A third important element of this system is managerial oversight. Managers can review and flag what employees enter for their hours, an important checkpoint to keep everything accurate and to correct the records if someone has struck the wrong notes. Managers can also monitor their employees to make sure they are showing up on time. In cases where attendance is an important part of performance appraisals and potential HR decisions, this can be valuable.

Gusto also has powerful tools for tracking requests for time off and paid time off (PTO). Employees can request time off through the system and, if approved by their managers, that time will be logged properly and reflected in payroll.

Gusto also offers the ability to track how much time your employees spend on tasks as a reporting and insight tool. As your company grows, being able to see what your employees have been doing, and therefore how you’re spending your labour dollars, is crucial for making better business decisions about what resources to invest in and how to improve your operations.

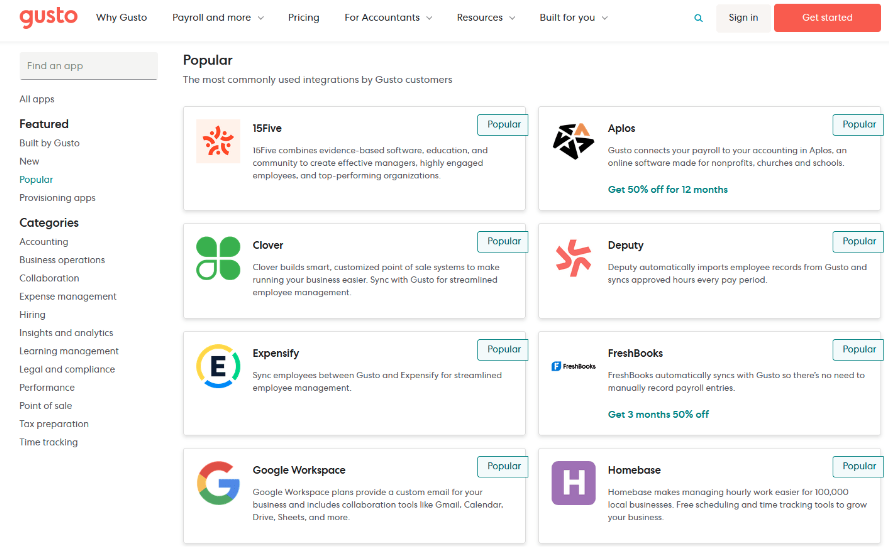

Integrations

Its integration pipeline has made it a powerhouse for any business, dramatically enhancing the depth and breath of its functionality for myriad business processes. The precise nature of connecting Gusto and other business tools and software offers unforeseen benefits in connecting core business operations like accounting, time tracking and expense management.

A prominent example of Gusto’s integrative power is its ability to sync with popular accounting programmes such as QuickBooks, Xero and FreshBooks, allowing for effortless automation of your payroll data to your accounting ledger. This is particularly important in maintaining the accuracy of your financial reporting, which in turn keeps your reported financials up to date.

Gusto integrates with leading accounting software (Source: Gusto)

Gusto also has strong integrations with time-tracking and scheduling apps such as TSheets (now QuickBooks Time), When I Work and Homebase. This enables Gusto to pull the time data into payroll accurately, and pay the correct amount to employees based on how long they worked. This is critical because the point of payroll is to pay employees.

Gusto’s capacity to integrate with many other systems makes it easier to handle employee reimbursement and track business expenses. Gusto’s capacity to ‘plug and play’ with many other systems means that it can become easier to manage employee reimbursement and hold an archive of employee business expenses, invoices and receipts to ensure the speedy and accurate processing of reimbursement via payroll.

Gusto also integrates with a host of other HR tools to expand its integrative capabilities in support of compliance, employee onboarding and benefits, through supplements to its core product.

Moreover, Gusto ties in with third-party financial planning and analysis applications to help businesses plan for their finances moving forward, including budgeting and economic forecasting uses. The ability to use payroll and HR data for deeper financial insights helps to better inform financial decisions.

Customer Support

Gusto’s customer support is highly rated – despite no 24/7 coverage like some competitors. Gusto reps are ‘very knowledgeable and patient’, ‘timely’ and ‘non-salesy’, users say. You can contact support via email or live chat, or (by phone) schedule a callback.

What Do Users Think About Gusto?

Gusto has received positive user reviews, with many commenting on how easy it is to use the interface. In fact, many also offered positive comments praising the quality of support Gusto’s customer service team provides. A small number of users mentioned minor issues with the software, like small bugs that would occasionally make you log out of your account.

Most users of the software considered Gusto to be good value for money for what it offers. Gusto’s employees were seen as very friendly and responsive to customer needs. Some users did highlight the weaknesses of the solution, such as how the support hours were more limited than some competitors’, and that there is no instant phone support – customers have to book in for a call back time. As well as this, some users felt that the services offered by Gusto did not provide good value for more complex payroll or HR needs as they would like. They expressed a desire for more in-depth customization options.

Gusto’s platform is appreciated for its HR resources, like the option to consult with HR professionals, which is especially beneficial for smaller businesses lacking a dedicated HR department.

Overall, on various online rating websites, Gusto gets high ratings. Ratings are typically given for things like how easy it is to use a platform, how many features it contains and how good a platform’s customer service is. However, the specific ratings vary across different reviewers, although Gusto gets relatively high ratings. For example, various websites rate Gusto highly in relation to other platforms in terms of user satisfaction and great value for money.

- Capterra rates Gusto 4,6 out of 5 (based on 3891 reviews)

- G2 rates Gusto 4,5 out of 5 (based on 1900+ reviews)

Gusto is ideal for the following…

- Small to medium-sized businesses with less than 150 employees

- Startups and growing companies

- Companies seeking an easy-to-use payroll system

- Businesses in need of comprehensive HR services

- Employers looking for employee benefits administration

- Companies requiring compliance management and support

- Organizations wanting integrated time tracking and workforce management

- Businesses looking for scalable solutions as they grow

- Companies interested in employee onboarding tools and resources

Gusto may not be ideal for the following…

- Large enterprises with complex payroll and HR needs

- Businesses with extensive international operations

- Companies requiring highly customized payroll and HR solutions

- Organizations needing advanced financial and accounting integration

- Firms with niche industry-specific compliance requirements

- Businesses preferring on-premises software over cloud-based solutions

- Companies needing 24/7 customer support

- Organizations looking for extensive project management tools

- Businesses requiring in-depth analytics and reporting capabilities beyond standard offerings

Conclusion

As a summary, if you want a comprehensive, versatile (from benefits to payroll processing) HR software for your SMB (small to medium sized business) that delivers great user experience and simplicity, Gusto seems ideal, but for larger companies or firms requiring more customized features, it is advisable to explore other options.

If you are not sure if Gusto is the right fit for your company check out its close competitor ADP TotalSource, in our review here