Written by: A Softinspect reviewer

What is Onpay?

On payment platform Onpay is a cloud-based payroll solution that is designed with the needs of small and medium-sized businesses in mind. The platform works well as an end-to-end solution as it adapts to the payroll complexity of a business by simplifying and automating the complete payroll lifecycle, making tasks such as calculating payments, making filings and paying employees on time easy.

In this Onpay Payroll Review 2024, we delve into what the Onpay Payroll is all about and check the latest features, usability, integration with other software, tax compliance, and overall customer support to give you a holistic understanding of how Onpay can be beneficial to your business.

Development

The idee that eventually led to Onpay was the idea for a solid payroll solution for small to medium businesses. The development of Onpay began with the creation of a decent payroll processing software with a minimum set of features. The first version with a very basic feature set was tested in limited areas with a few users, but it was the starting point of Onpay.

With an increasing base of users, the team began building out capabilities such as automatic tax calculations and direct deposit, while the front-end became much easier to use.

The adoption of innovative technologies, especially of the cloud computing variety, has been central to Onpay in the late 2010s – not only to make the platform accessible but to enhance its data-security and compliance capabilities.

As it developed, it continued to respond to changes in tax law and user feedback, so that over the years it was transformed several times into a different type of platform, one that was technologically more sophisticated and yet – importantly – it remained easy and intuitive for customers to use as the target market developed. By 2023, Onpay emerged as a comprehensive, easy-to-use payroll service.

Pros

✅ Onpay is highly user-friendly, with an interface that’s easy for users of all skill levels, making it a great choice for small and medium-sized businesses

✅ Using the platform, users can access features such as automatic tax calculations, direct deposit and a host of customizable payroll reports, which cover the majority of their payroll needs.

✅ Onpay keeps up to date with the relevant tax statutes and regulations, helping businesses to remain compliant without having to track legislation.

✅ It integrates well with other systems such as accounting and HR software, which enables more efficient workflow management.

✅ Onpay has solid customer service including tutorials, help desks and live support.

✅ No tiered pricing, and good value for your money

✅ The platform includes HR resources without additional charges

Cons

❌ It doesn’t offer much in the way of customization (for example, you may find it offers insufficient capabilities to meet certain payroll requirements). Sometimes it can’t offer what you need to work best for your unique business.

❌ Any new user, including those who have never used payroll software before, could have a slight learning curve in making sure they have taken advantage of all the features. But again, same applies for all other PEO payroll platforms available.

❌ Payroll runs require several steps

❌ No auto pay option

Pricing and Plans

Pricing is an all-in bundle, including everything, with a base price of $40/month plus $6/user/month, so a business would pay a flat monthly price for the base plan alongside a fee for each employee on a business’s payroll. The plan includes just about everything a business would need, including unlimited monthly payruns, tax form filings with the appropriate governmental agencies (wage and tax statement, known as a W2; an IRS 1099 form), an employee self-service portal, support, a variety of HR tools, and software integrations with other applications such as time and attendance, benefits, performance and other workforce and time management systems.

Onpay offers a pay-only pricing model, meaning that there are no hidden fees. The company charges a straightforward $36 per month fee plus a $4 flat per-employee fee and, since there is no additional fee for multi-state payroll, it’s a dream for employers with employees in multiple states.

New subscribers to Onpay can avail a free trial where they get the 1st month free, as well as free onboarding and support from the Onpay team.

Key Features

Employee Self Service

Employee Self-Service, a system feature in OnPay’s product, is a separate portal in which employees can independently access and update their payroll information. The portal is a central place where employees can see their pay stubs, download their tax forms (including W-2s and 1099s), and update any aspects of payroll entries such as their bank details for direct deposit or tax allowance preferences.

Payroll Processing

‘Payroll processing’ is an essential part of any organizational activity. In a nutshell, it is the processing connected with the wages payment by one company to its employees.

Onpay takes its payroll processing very seriously. It tries to make this process as straightforward as possible for any business out there.

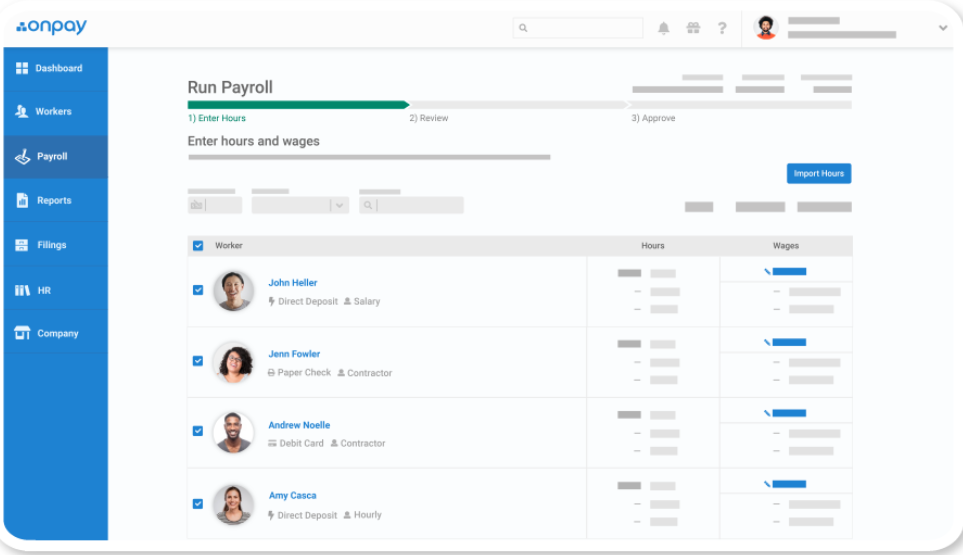

The first step in payroll processing involves setting up and maintaining employee information, such as names, personal details, taxes and bank account details for direct deposit that will be paid through these banks. Employers may set up this data manually or import the information from HR systems.

It calculates each of the employees’ pay automatically based on their respective hourly pay rates or salary, once you input their data. It also handles things such as the policy of paying staff hourly for over-time pay, quarterly bonuses, and miscellaneous commissions. Other forms of compensation (stock options and the like) are handled manually outside of this system. It also calculates all employees’ taxes, health insurance, and retirement contributions on an ongoing basis.

Payroll dashboard (Source: OnPay)

Tax Withholding and Filings

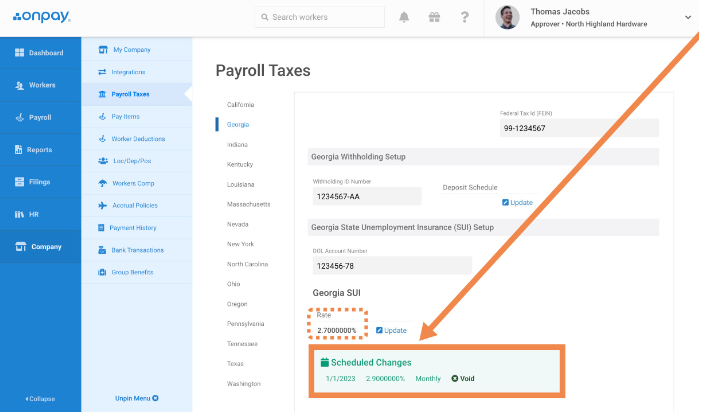

Tax management is an important part of the payroll process, so OnPay’s capabilities in this area will likely have the largest impact for some businesses. The software will automatically calculate the appropriate amount to withhold from an employee’s paychecks to satisfy federal, state, and local taxes based on the tax rates applicable for the business’ location and the employee’s income, filing status, dependents, exemptions and so forth. This will help businesses avoid noncompliance with the evolving and involved tax code.

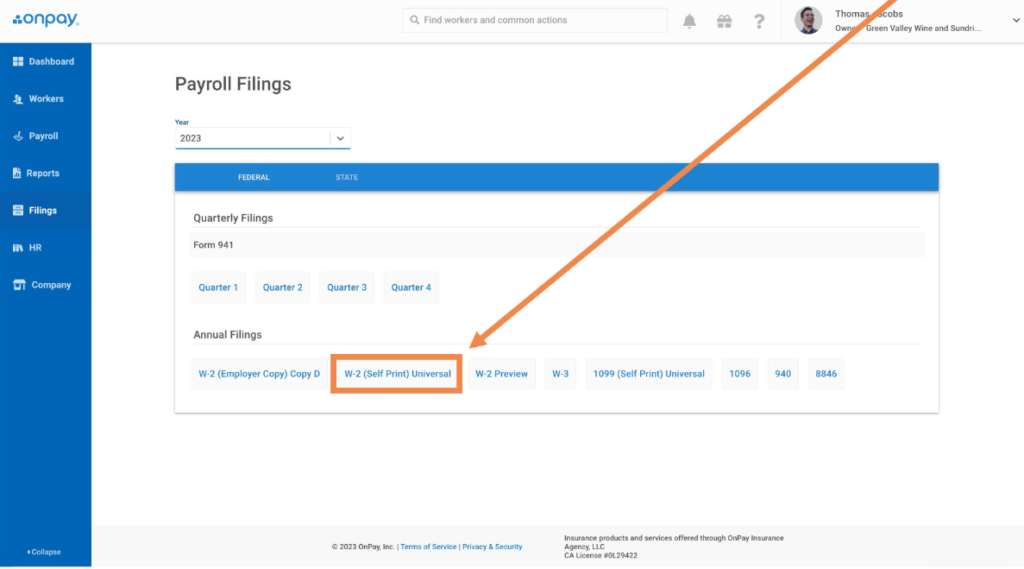

Beyond tax calculation and tax withholding, payroll management also involves generating and filing quarterly and annual tax documents. Figuring out, preparing and submitting various tax filings can pose a profound challenge for small and medium-size businesses, which are often inadequately staffed and face constraints in hiring new personnel. OnPay automates this part of bookkeeping, generating and submitting all necessary paperwork to tax authorities on the company’s behalf. Such services significantly relax the administrative burden for businesses, and eliminate the risk of making filing mistakes that can lead to penalties and audits.

In Payroll Taxes you can add or update state payroll tax information (Source: Onpay)

Furthermore, OnPay will take care of year-end responsibilities including W-2 and 1099 forms for employees and contractors to ensure compliance with tax reporting.

You can create a printable batch of all employees W-2s (Source: Onpay)

Pay Distribution and Reports

OnPay handles payroll by making automatic deposits, ensuring that your employees get paid on time directly into their checking accounts while also giving you the option to write out cheques, in case your business is set in its ways.

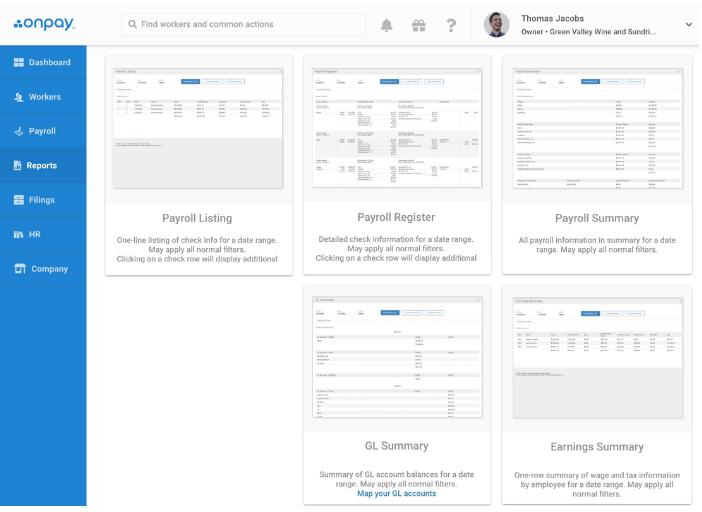

Once payroll has been processed, OnPay returns various payroll reports that are readily formatted for accounting purposes, and whose information allows for superior planning, budgeting and financial management by giving managers a better understanding of their labour costs. These reports can be customized to focus only on the data points that are important for the business.

Payroll Reports Dashboard displaying key payroll metrics and insights (Source: Onpay)

The Payroll Reports Overview includes quick access links to your most important reports (Source: Onpay)

Compliance and Record Keeping

OnPay’s built-in compliance makes payroll run smoother and also manages critical tasks such as onboarding new employees and tracking 1099 payments. The company also serves as a records-keeper for businesses, automatically updating its payroll software as federal, state and local law changes. That way businesses don’t have to spend time manually changing their tax and labour regulations when there’s an update.

The platform keeps a detailed record of each payroll entry, such as how much was paid to whom (including taxes withheld) and why it was paid (with whom and for what reason). This record also shows any adjustments or offsets to previously issued checks.

It lets you automate updates to compliance requirements, and keeps a robust log of all payroll activities. That lowers the risk of penalties resulting from wrong information or overlooking important details.

Integrations

With OnPay, by integrating users’ payroll system with other data systems, it extends its payroll process and saves a considerable chunk of time that would usually be spent on data entry. OnPay’s integrations make it easy for the users to connect their payroll with a variety of business tools, such as accounting system, HR systems, time tracking apps, as well as benefits management platforms.

For example, integrating OnPay with accounting software automatically transfers payroll expenditures, taxes and other financial data to the company’s accounting ledger, where they can then be accounted for. This integration saves time and lessens the margin of error that comes with manually entering data, ensuring that financial reporting is accurate and current.

For example, with connection to HR systems, OnPay will automatically exchange data (currently, it includes employee names and addresses, pay changes and benefits enrollments) between systems so that HR and payroll records align perfectly, enhancing the accuracy and efficiency of payroll processing as well as the management of employee data.

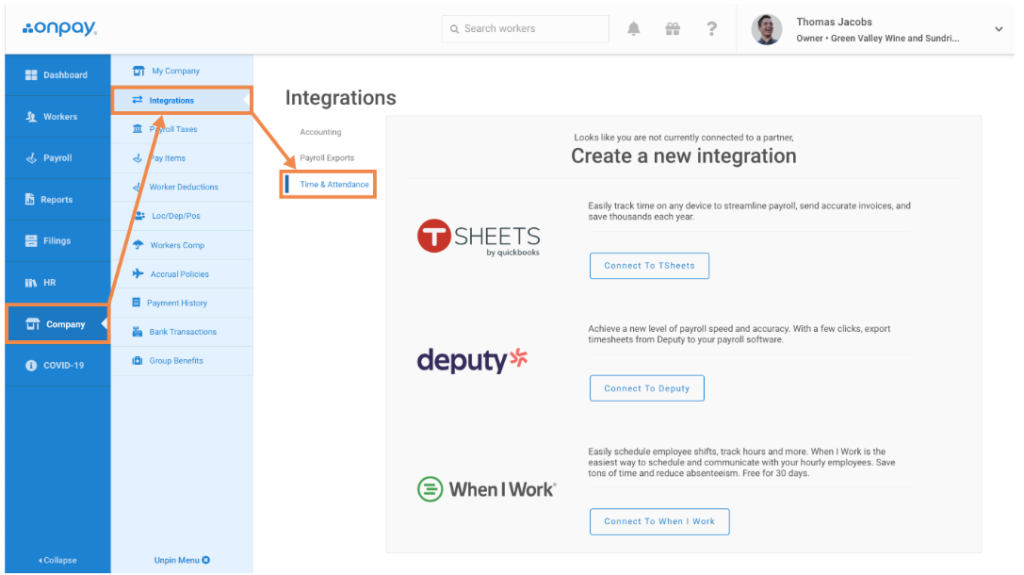

Integration with time tracking software such as QuickBooks Time (formerly TSheets), When I Work and Deputy help to streamline payroll processes. Hours worked, overtime and vacation are calculated and uploaded from the time sheets into the payroll system, thereby paying people appropriately for their time and ensuring compliance with labour laws.

Under integrations and time and attendance you can easily add a new time tracking application (Source: Onpay)

It also integrates with QuickBooks Online and Desktop for accounting, and Guideline and Vestwell for 401(k) and retirement planning. Mineral for HR and compliance, PosterElite for labour law compliance, and Magnify for agriculture business management.

Cloud-Based Accessibility

Cloud-based access to OnPay enables payroll management from practically anywhere. This is particularly important for companies with remote or hybrid work teams, the ability to perform payroll functions without regard to geographic location is a critical element of operational efficiency and of business continuity – today and tomorrow.

Customer Support and Resources

Their support helps users answer questions and solve problems.

Overall, OnPay users are generally satisfied with the customer service. The company’s support team is described as helpful, friendly and responsive.

OnPay offers both phone-support and online-support, which users describe as convenient and effective.

The reviewers’ rating on G2 gives the platform a 4.8-star overall score, based on more than 270 customer reviews. Users value its simplistic functionality and comprehensive features, however some have reported a difficult learning curve due to the menu’s confusing layout and dysfunctionality on some browsers.

TrustRadius customer reviews give OnPay a 6.8 out of 10, and note its efficiency and value for small businesses. OnPay users in reviews describe the product as simple, easy to use, and for having fast and helpful customer support, along with solid payroll and tax accounting.

OnPay is known for being affordable and for its automatically scheduling payments, having flexible payment dates, not charging additional fees, and having multiple employees and location capabilities with unlimited monthly pay runs, automated tax payments and filings. There were few user complaints, but some wished for more customization options and advanced features.

It’s also noted for limited third-party integrations and the absence of a built-in time-tracking solution, but it has as mentioned good time tracking integrations through apps like QuickBooks Time (formerly TSheets), When I Work and Deputy. OnPay is known for being pretty straightforward, you’ll likely be happy with it if you’re looking to efficiently pay a small to medium business.

Onpay is ideal for the following…

- Small to medium-sized businesses requiring comprehensive payroll services.

- Businesses across various industries, including hospitality, nonprofits, and agriculture, seeking tailored payroll solutions.

- Organizations looking for integrated payroll with benefits management, HR, and compliance features.

- Companies needing flexible payroll features that support a mix of full-time, part-time, and freelance staff.

- Businesses aiming to streamline payroll processes with automation and ensure compliance with tax regulations.

Onpay is not ideal for the following..

- Very large enterprises with complex global payroll needs that require specialized software.

- Businesses seeking highly customizable payroll software that can be extensively tailored to unique processes.

- Companies looking for free payroll services, as OnPay charges a monthly fee.

- Companies that prefer a payroll service that provides face-to-face service or has one account manager servicing one client.

Conclusion

To conclude, OnPay is a simple, scalable, science-based payroll platform that is suitable for small to medium businesses in all industries (as well as nonprofits). Given that the platform is in the cloud and easily integrable, OnPay is a viable partner or option for your company as your business grows. To learn more about OnPay, visit their website.

If you are not sure if Onpay is the right fit for your company check out its close competitor Gusto in our review here