Written by: Darryl Johnson

Patriot Payroll is a powerful payroll solution that simplifies the payroll process for small and medium sized businesses (SMB). It provides payroll tax, direct deposit, and year-end forms like W-2s and 1099s for your small business. It’s also a cheap, simple and easy to use platform that is highly rated among small business owners.

In this Patriot Payroll Reviews 2025 we will look at what the platform has to offers, how much it costs, and what the potential downsides are, so that you can decide if it’s right for your business.

Pros

✅ Patriot Payroll’s simple dashboard makes payroll management easy. Payroll newbies won’t struggle to use the platform as it is easy to learn and setup.

✅ Automatic tax filing — In supported states. Patriot automatically does the federal, state and local tax filings so that you get less mistakes and pay the correct taxes.

✅ Patriot is affordable with no hidden costs or charges due to its transparent pricing system.

✅ Very good employee portals.

Cons

❌ The software is limited to U.S.-based companies — Not suitable for international or multinational organizations.

❌ It has no advanced HR integrations, and lacks features like benefits administration and time tracking, though time tracking is available as an added extension.

❌ Businesses in certain states must manually file taxes, which can be cumbersome.

Pricing and Plans

Patriot Software has two payroll packages that fit small businesses: Basic Payroll and Full Service Payroll.

Basic Payroll: $17 per month + $4/employee. You can run as many payrolls as you like, it does payroll tax computation, but you will need to file and pay taxes yourself.

Full Service Payroll: This plan provides all of the same benefits as the Basic plan, at $37 per month + $4 per employee, plus Patriot does the taxes and pay-ins on your payroll for you.

Both plans have free direct deposit, an employee portal, and allow you to choose multiple pay cycles

In addition to payroll services Patriot provides optional extensions to power your HR and time-tracking:

- Time and Attendance: For an additional $6 per month + $2 per employee, this feature allows you to track employee hours seamlessly.

- HR Software: At $6 per month + $2 per employee, this add-on provides tools for managing employee information and documents.

| Plan | Base Monthly Fee | Per Employee Fee | Features |

|---|---|---|---|

| Basic Payroll | $17 | $4 | Unlimited payrolls, payroll tax calculations (you file and pay taxes) |

| Full Service Payroll | $37 | $4 | Unlimited payrolls, payroll tax calculations, Patriot files and pays taxes on your behalf |

Patriot’s transparent pricing and flexible add-ons make it a suitable choice for small businesses seeking customizable payroll solutions.

How does it compare in pricing to its closest competitors

Here’s how Patriot Payroll stacks up to its nearest competitors:

| Provider | Base Monthly Fee | Per Employee Fee | Key Features |

|---|---|---|---|

| Patriot Payroll | $17 – $37 | $4 | Basic and Full Service plans; Full Service includes tax filing and payments. |

| Gusto | $40 | $6 | Comprehensive payroll with benefits administration and HR tools. |

| OnPay | $40 | $6 | Full-service payroll with integrated HR and benefits management. |

| Quickbooks | $45 | $5 | Scalable payroll services with robust HR features. |

| Square Payroll | $39 | $6 | Simplified payroll processing, ideal for businesses already using Square. |

Key Features

Patriot Payroll is known for being simple and affordable, which is why small business are choosing it. Here’s a breakdown of the main benefits, along with potential drawbacks.

Payroll Processing

Patriot payroll lets you conduct unlimited payrolls for salaried employees, hourly workers, and contractors and let’s you set your payment frequency. Whether you want bi-weekly or monthly Payroll Runs, Patriot empowers you to define your pay frequency and payment arrangements. The automatic tax calculation and payroll reporting features are designed to save you time on admins while also keeping payroll in check.

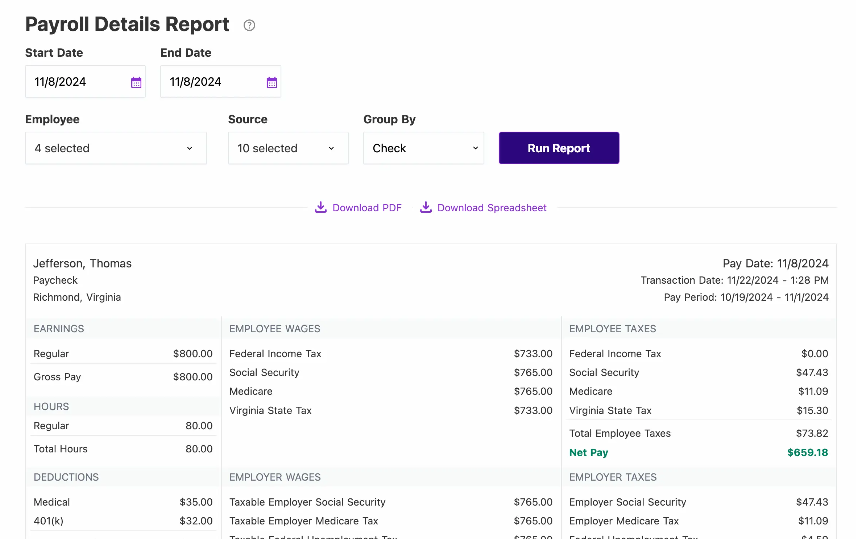

In the payroll Details Report you can see year-to-date details about location, employee, checks or totals. You can also download the report either in PDF or CSV file format (Source: Patriot)

Unlimited Payroll Runs for Maximum Flexibility

With Patriot Payroll, you’re not restricted to a certain number of payroll runs per month. You can process payroll as many times you need without extra charges. This is especially helpful if your company has several different worker categories paid on different schedules. You can pay hourly workers on a weekly basis, for instance, but pay salaried workers biweekly or monthly.

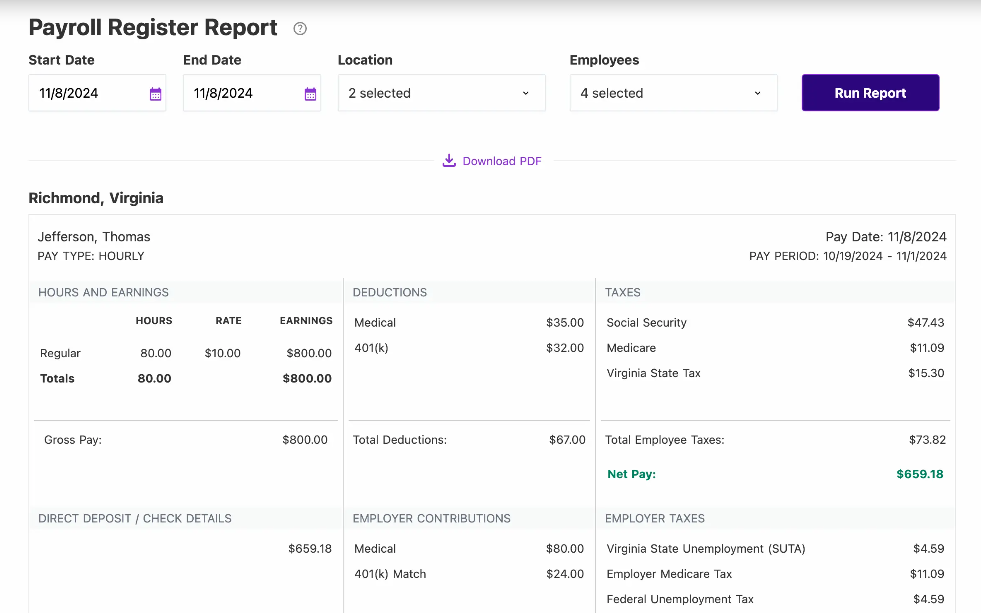

In the Payroll Register Report you can view all the payroll you have run for all your employees, and you can easily view it by pay date. You can see information such as employee hour, earnings, taxes withheld and deductions, employer taxes owed and contributions (Source: Patriot)

You also have options for different rates for workers based on function or duties. The platform supports different pay cycles and gives you options of payment formats for your business like direct deposit, printed check, or cash.

Automatic Payroll Tax Calculations

This is the best time saver of Patriot Payroll as you don’t have to bother with doing any manual payroll tax. The platform calculates the federal, state and local payroll taxes based on your information. This includes social security, medicare, unemployment insurance, etc.

For those on the Full Service Payroll plan, Patriot does all the tax filings and payments for you. This means Patriot files your federal, state, and local taxes, so you don’t have to. At the end of the year the system produces and issues W-2 and 1099 forms for your workers and subcontractors.

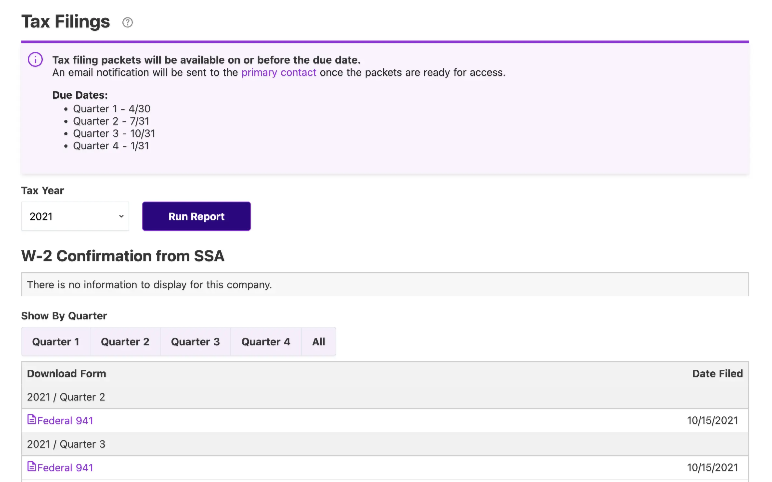

You can view all of the tax returns Patriot has filet for you. You can choose the tax year and view tax filings by quarter. You can also download the form and see when Patriot filed them for you. (Source: Patriot)

Potential Drawback: Tax Filing Limitations

Auto-filing of taxes is included in the Full Service Payroll plan, but only for U.S. businesses. Patriot can’t be used to file payroll taxes internationally which is a pain if your business is global.

Three-Step Payroll Process

Patriot’s payroll processing process is made to be easy and efficient and it consists of 3 steps:

- Enter Employee Hours – You input the regular hours, overtime, and any extra payments such as bonuses or commissions manually. Time off for employees automatically syncs if you’ve subscribed to the Time and Attendance add-on.

- Approve Payroll – The platform sends you a payroll report showing total pay, deductions and net pay per employee. You’ll also see a breakdown of payroll tax amounts.

- Run Payroll – Run Payroll – Once you have seen and approved the payroll summary, you can process payroll and pay your employees via direct deposit or other methods.

Employee Payments and Contractor Management

Patriot Payroll lets you pay W-2 workers and 1099 contractors all in one place. This is helpful for companies that work with freelancers or independent contractors because you do not need to create an additional contractor payment system.

The platform offers flexible payment options, including:

- Direct Deposit – Free with both payroll plans.

- Check Printing – Print and generate checks for employees if you want.

- Cash Advances – Cash advances are supported as well, although they are uncommon.

Potential Drawback: Processing Times for Direct Deposit

Direct deposit is free but Patriot’s average processing time is four business days. Some competitors default faster processing. Patriot actually does have a 2-day direct deposit, but only to those who are eligible for that.

Payroll Reporting

Patriot offers several payroll reports so you’re always in control of your payroll costs and taxes. These are payroll reports including salary figures, deductions, contributions and payroll taxes. You can export the reports or send them to your accountant so you can easily track payroll expenses and comply.

But the reporting on the platform is less robust than some competitors. Patriot, for instance, doesn’t provide visual dashboards to quickly get a handle on payroll data trends.

Potential Drawback: Limited Customization of Reports

The standard reports have all the key payroll data you need, but you might be limited in your customization. If you need a very precise or specific business report then you will need to look elsewhere than Patriot for the reporting capabilities.

Basic Payroll vs. Full Service Payroll

Patriot offers two distinct payroll plans with varying levels of service:

| Feature | Basic Payroll | Full Service Payroll |

|---|---|---|

| Payroll Processing | Unlimited runs, multiple pay rates, payment methods | Same as Basic |

| Payroll Tax Calculations | Calculated, but you must file taxes yourself | Patriot files and pays all payroll taxes on your behalf |

| Tax Forms (W-2s & 1099s) | You must generate and file tax forms | Patriot generates and files W-2s and 1099s for you |

| Compliance | You handle compliance requirements | Patriot ensures tax compliance |

With the Basic Payroll plan, you are in charge of filing taxes on wages and generating forms. This is the plan that’s best for those businesses that are looking to keep things affordable and have experience with filing taxes.

The Full Service Payroll plan is better if you’d rather offload tax preparation and compliance to Patriot. This package will keep your business on track with federal, state, and local tax regulations and save you time.

Time and Attendance Integration

If you would like to monitor your employees’ time effectively, Patriot has a Time and Attendance add-on for an additional charge. It integrates employee hours directly with payroll so there’s little to no room for human error on pay.

The Time and Attendance Add-On is $7 per month + $2 per employee. Businesses can keep track of employee hours easily and thus make sure the payrolls are paid accurately. Employees can clock in and out, while managers can track attendance. This extension works with Patriot Payroll, so you don’t have to enter hours manually, which saves time and errors.

It’s great for companies who need time-tracking to make life a little easier, but may be insufficient for larger companies with heavy scheduling, because the add-on is quite limited (basic time tracking) when it comes to time-tracking.

Some of Patriots competitors do offer time-tracking in their basic payroll plans, so you might want to consider them if you are looking for something that’s all in one, but it might come at a slightly higher price.

Tax Filing and Payments

Patriot Payroll simplifies tax filing and payments, making it easier for small businesses to stay compliant.

Full Service Payroll: With the Full Service plan for businesses, Patriot computes, tracks and processes your federal, state, and local taxes for you. That goes for year-end W-2s (for workers) and 1099s (for contractors), so you don’t have to worry about any additional effort to get your taxes paid. The software knows when deadlines are, and files automatically for you so you never forget.

Basic Payroll: In the Basic Payroll plan, Patriot calculates taxes for you, but you have to file and pay taxes yourself. It gives you complete reports of the tax due amount but it is your responsibility to manually submit taxes.

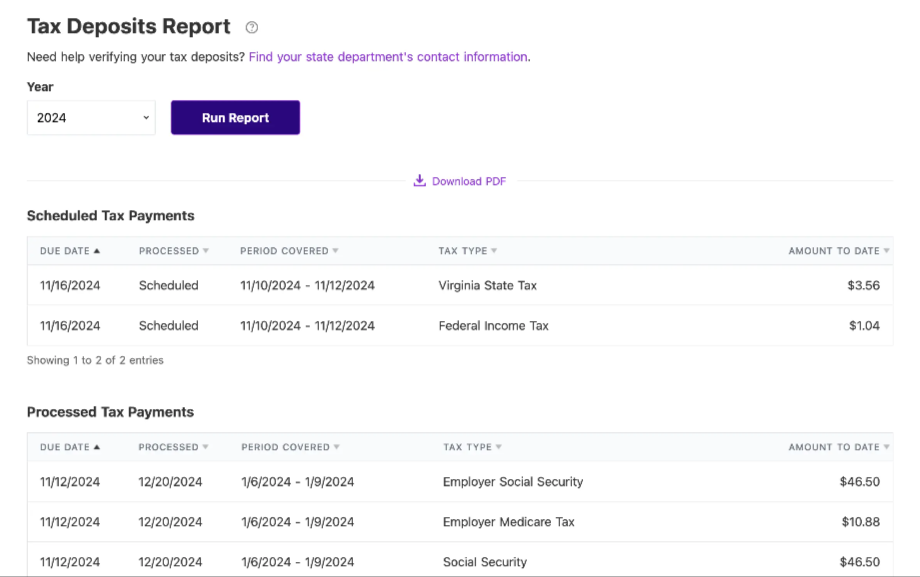

The Tax Deposits Report shows all the payroll taxes that Patriot has deposited with tax agencies on your behalf. You can pick a year to view the paid and scheduled taxes (Source: Patriot)

Benefits of Patriot’s Tax Filing

- Automatic Tax Calculations: Patriot automatically calculates payroll taxes, ensuring accuracy and reducing the risk of errors.

- Filing & Paying Your Taxes: With Full Service Payroll, Patriot handles your tax filing and payment, including federal, state, and local taxes.

- Tax Reports at Year-End: Patriot automatically produces W-2s and 1099s for employees and contractors.

Potential Drawbacks

- Basic Payroll Requires Self-Filing: You must file taxes yourself with the Basic plan.

- Limited Global Payroll: Patriot only works for US-based tax filings, which will require another provider for companies in foreign countries.

- Limits On Filing Local Taxes: Some local taxes may require manual handling, depending on your location.

Summary

Patriot Payroll Tax Filing & Payment saves you time and effort by performing calculations and filing automatically. The Full Service option is best for the companies who want a hands-off solution, while the Basic Payroll is cheaper if you feel like doing tax returns on your own.

Employee Self-Service Portal

The Patriot Payroll Employee Self-Service Portal makes it quick and simple for employees to get their paychecks, pay stubs, hours worked, and W-2 and 1099 tax forms. It’s also possible for workers to make personal updates on addresses and direct deposit details which means less manual work for HR.

This self-service functionality automates the payroll process and eliminates questions from employees, which is time saving for companies. Employees unfamiliar with the self-service portal may face difficulties navigating it. Additionally, if personal information is updated incorrectly, it could lead to payroll errors, such as inaccurate tax withholdings or incorrect payment details.

The Employee Self-Service Portal is a great tool that can help increase efficiency and visibility, but would probably need a little assistance for employees that require it.

Direct Deposit

Direct Deposit with Patriot Payroll is available at no additional charge with Basic Payroll and Full Service Payroll. Workers get paid through their bank account, faster and more secure without having to write any checks. This functionality saves time on administrative activities and delays in checks or missing checks.

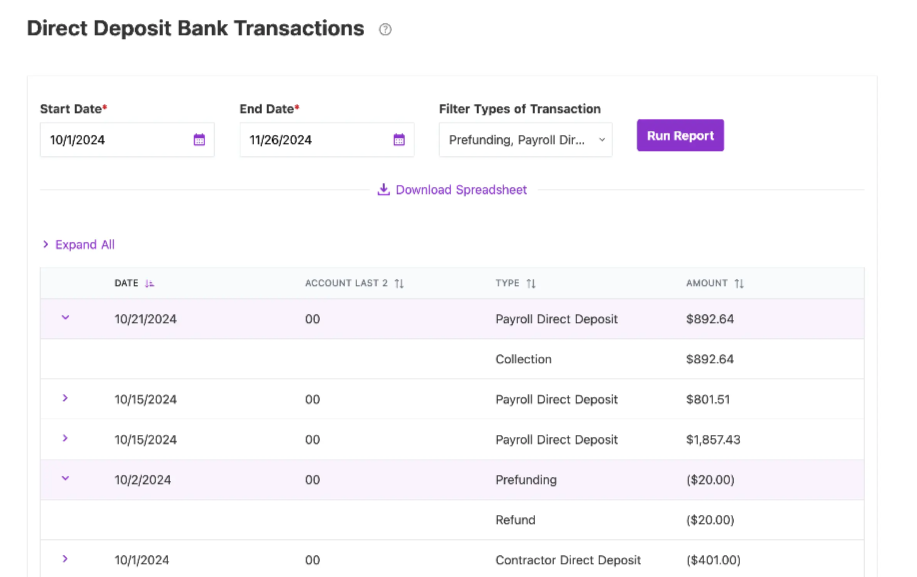

The Direct Deposit Bank Transactions reports give you a clear and detailed view of all your direct deposit collections, from employee and contractor payrolls to pre-funding (Source: Patriot)

For employers, there are benefits of a faster pay-roll processing wherein funds will be sent directly to the workers’ account once the pay is made. You can also have employees direct deposit multiple accounts. It is a free service, but the fees may be processed up to four business days after receipt (unless two-day direct deposit is chosen at an additional charge).

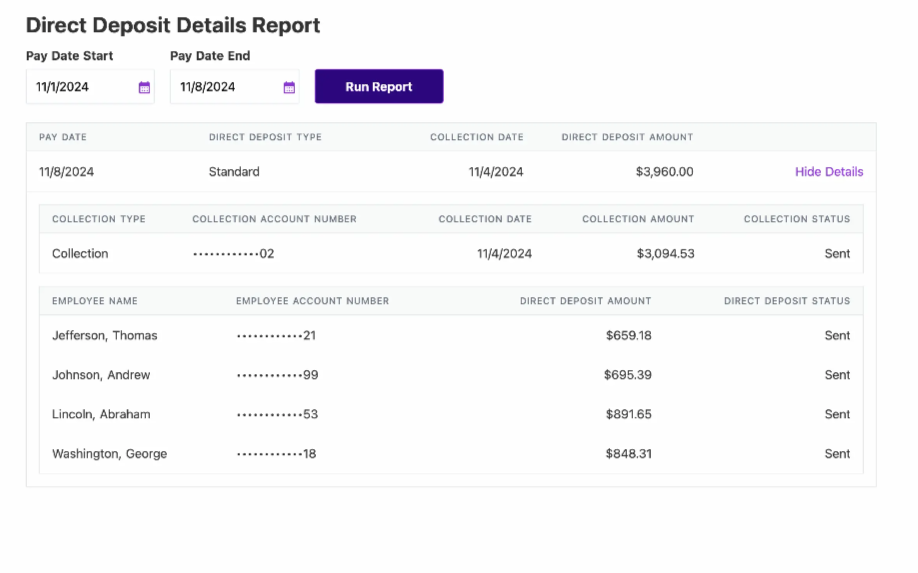

This report provides a comprehensive overview of your employee and contractor direct deposits. You can track payment statuses, identify bank accounts, and ensure accurate payroll (Source: Patriot)

Overall, direct deposit enhances payroll efficiency, and it ensures timely and secure payments with minimal effort from employers.

HR Software Add-On

The Patriot Payroll HR Software Add-On at $6 per month + $2 per employee allows businesses to manage all their employees in one place. You can store contacts, positions, tax information, and benefits enrollment which makes HR easy. The Self-Service Portal can be used by employees too, making HR’s work easier.

But the add-on doesn’t have HR functions such as performance reports or any recruitment tools, which bigger businesses may want. Companies that have HR software already, may find it redundant.

The HR Software Add-On is a reasonable and inexpensive choice for small to medium-sized businesses to make HR more convenient, but it may not have the necessary functions required by a larger organization.

What You’ll Like:

- Centralizes employee records and documents.

- Lets you keep track of employees anniversaries, certificates, etc.

- Helps with compliance by keeping employment documents organized.

Potential Drawbacks:

- Added fee: HR fee is $6/month and $2 per employee.

- Not an HR package: HR tools are simple compared to BambooHR or Gusto.

- Absent benefits management: Patriot’s HR system doesn’t have benefits administration.

Reporting and Analytics

Patriot Payroll also provides Reporting and Analytics features to aid companies in executing and reporting on payroll data. From various reports you can easily track employees’ salaries, taxes, deductions and benefits. Payroll summaries, tax filings, and year-end forms like W-2s and 1099s are essential reports to help you stay organized and prepared for tax season.

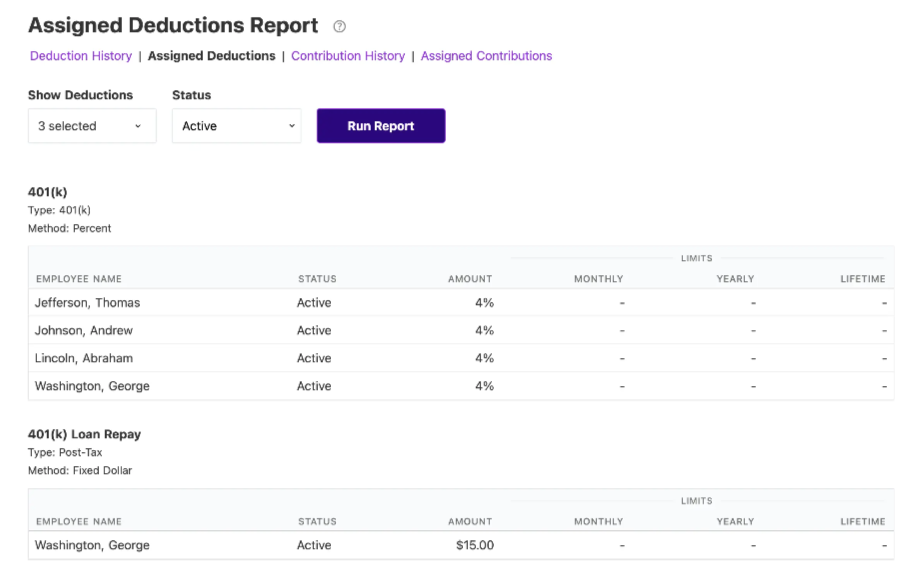

With the designated deduction report you can view future payroll deductions you have scheduled. This report separates workers by deductions (e.g., medical). And you can sort by deduction or status (e.g active). This is a future – not past – conclusion report. (Source: Patriot)

The Analytics gives you insights on your payroll data so you can monitor labor expenses, employee salary and tax payments. They can be exported as CSV or PDF reports, which are great for sharing with accountants or stakeholders.

The reporting tools are user friendly, with just enough information for small businesses to efficiently run their payroll.

Potential Drawbacks

Patriot Payroll’s Reporting and Analytics module offers important payroll reports like payroll summaries, tax filings, and year-end reports. The interface is simple and the exports are in CSV or PDF but it only handles payroll data, and it doesn’t offer much customization options.

The downside can be that the analytics is rather primitive, so it is not a good option for companies looking for sophisticated financial analytics or labor cost analysis. The reports are also less customizable than some other platforms, which might be limiting for some businesses.

Basically, Patriot’s reporting capabilities work fine for small companies with focus on payroll compliance but might not work for large companies with more complex reporting needs.

Ease of Use

Patriot Payroll is very user-friendly with an easy-to-use interface for processing payroll for small businesses. Employee profiles are easy to create and payroll is simple with little technical expertise. The platform walks the user through every stage so you can start using it immediately and conduct payroll with ease.

It is easy to use, but the system may not be as powerful or customizable as it could be for companies with more elaborate payroll requirements. Overall Patriot Payroll is a great option for small business that just needs an easy, quick payroll service, though larger businesses that have more complex needs may need something extra.

The interface is another important strength of Patriot Payroll. It is also easy to use even for those with no experience with payroll.

Summary of Key Features and Drawbacks

| Key Feature | What You’ll Like | Potential Drawbacks |

|---|---|---|

| Payroll Processing | Unlimited payroll runs, multiple payment methods | No global payroll support, limited integrations |

| Tax Filing and Payments | Automatic tax filing, year-end forms included | Only in Full Service plan, U.S. only |

| Employee Self-Service | Easy access to pay stubs and tax forms | Limited customization, no mobile app |

| Direct Deposit | Free with both plans, fast processing | Limited payment methods, bank-dependent delays |

| Time and Attendance | Tracks hours and overtime, syncs with payroll | Additional cost, lacks advanced features |

| HR Software | Centralized employee records, compliance tools | Additional cost, no benefits administration |

| Reporting and Analytics | Pre-built reports, customizable options | Limited advanced reports, no visual dashboards |

| Ease of Use | Intuitive interface, great customer support | Limited advanced features, no mobile app |

Patriot Payroll is great, and comes at a reasonable price, it also offers decent functionality. But if you need HR software with stronger functionality or more integrations, you might consider rivals such as Gusto or OnPay. But if your small business is just about payroll and no extraneous services, Patriot is an excellent option.

Customer Support

| Support Channel | Availability | Features | Potential Drawbacks |

|---|---|---|---|

| Phone Support | Monday to Friday, 9 AM – 7 PM ET | Direct access to support representatives for real-time assistance | Limited to business hours, no weekend support |

| Email Support | 24/7 availability | Submit questions anytime, with responses typically within 1 business day | Slower than phone or chat support |

| Live Chat | Monday to Friday, during business hours | Quick assistance for simple queries via website chat | Not available outside business hours |

| Help Center/Knowledge Base | 24/7 availability | Extensive library of guides, FAQs, and tutorials for self-help | May not cover all complex issues |

| Video Tutorials | 24/7 availability | Step-by-step video guides for common tasks like payroll setup | Limited to pre-recorded content |

Key Takeaways

There are various customer support options, including telephone, email, live chat, and self-help articles. But it is only supported during the business hours in the United States, and there’s no weekend support. Phone and chat are best for a resolution on the go and the Help Center if you want self-service.

How does the biggest review sites rate Patriot

G2: 4.8 out of 5

GetApp: 4.8 out of 5

TrustRadius: 9.5 out of 10

Capterra: 4.7 out of 5

Conclusion

Patriot Payroll is a great choice for small businesses because it is affordable, easy to use, and caters to U.S. payroll. If you’re a small business that just needs payroll, and has no complicated international payments or advanced HR capabilities, you’ll love Patriot’s user friendliness and affordability.

But if you need more advanced payroll software with global payroll integrations or a wide range of integrations, then check out Gusto or QuickBooks Payroll.

In short, Patriot Payroll’s payroll processing system was developed to make payroll as easy for small companies as possible without spending time on paperwork. Its simple workflow, unlimited runs, and tax calculations are surefire benefits for any small business owner who needs a simple way to automate their payroll.

Patriot Payroll is best suited for:

- Small businesses needing a simple, affordable payroll solution.

- Companies that have employees in the United States (it works only for US tax filings).

- Small to medium sized business owners that need a simple payroll platform.

- Employers who want automated tax filing (Full Service Payroll plan).

- Organizations needing basic time tracking with the optional Time and Attendance add-on.

- Businesses looking for value with transparent, low pricing.

Patriot Payroll may not be as well-suited for:

- Large Companies – Payroll with high volume or lots of people.

- International companies that need payroll support outside the U.S.

- Enterprises that need something more than basic payroll data for reports or detailed analytics.

- Businesses that have complicated time management requirements – because the Time and Attendance plugin is quite basic.

- Companies needing extensive integrations with other business tools or software.

- Companies who need same-day direct deposit without wanting to pay extra for faster processing.

If you need more advanced payroll software with global payroll integrations or a wide range of integrations, then check out our Gusto review here or our QuickBooks Payroll review here.