Written By: Daryl Johnson

Wave Payroll is a cloud payroll system to make payroll simple for small businesses. It provides automated tax forms, direct deposit and employee self-service portals. Created for SMBs, Wave Payroll syncs with Wave’s free accounting platform for a total financial management system. This integration is particularly useful for businesses that want to cut the clutter without having to manage several software platforms.

In this Wave Payroll Review 2025 we will look closer at the platforms key features, costs and potential drawbacks so you know whether it is right for your company.

Pros

✅ User friendly interface, easy to learn for SMB’s (small to medium sized businesses) — The platform is simple and it is accessible even to those who have no previous payroll experience. Its easy to navigate design means there is no learning curve, and your business can go live right away. Wave Payroll even comes with a set of handy tooltips and a step-by-step guide for getting payroll setup on the right track for first-time users.

✅ Automatic tax filing for hassle-free filing (available in certain states)—Wave Payroll automates your tax filing, so you stay compliant without any hassle. It is a feature that reduces mistakes and missed deadlines, which could result in penalties. Tax rates are automatically updated so companies always comply with current laws.

✅ Automatic integration with Wave Accounting for integrated experience — Integrating payroll and accounting means no more hand-coding, saving you time and making sure all records are accurate. The integration also lets you see labour expenses in real time, which is an advantage for businesses with small budgets.

✅ Employee self-service for pay stubs and tax returns—Employees can access their documents anywhere anytime which eliminates burden on employers. The portal also offers direct deposit modification and other update options, giving employees more visibility into their data.

✅ A great budget-friendly solution for small businesses — Unlike other payroll software, Wave Payroll’s pricing model is simple and affordable, so it is a smart choice for startups and small businesses. It also doesn’t have any hidden charges or intricate levels of pricing which appeals to budget users.

Cons

❌ Only available for US and Canadian companies — Wave Payroll isn’t available to companies that are based outside of the US and Canada, so it’s not ideal for multinational companies. It is good in the existing markets, but for businesses with global staff this could be a big limitation.

❌ Tax filing is automated only in 14 US states – Businesses in other states have to file their taxes by hand, which can be tedious for those not familiar with local taxes. This might be tricky for companies in multiple states.

❌ No advanced HR functionality or integrations—If you are a company that needs robust HR functionality, like benefits administration or performance management, Wave Payroll isn’t the right solution for you. It doesn’t integrate with well-known HR systems and is therefore not that useful for larger teams.

❌ Pay schedules and reports have limited customizable options — works fine for rudimentary payroll operations, but lack of customizable capabilities could be unsuited for companies that have complex payroll systems or reporting needs. Users who want to drill down into payroll data will have to supplement with third-party resources.

Pricing and Plans

Starter Plan: This free plan gives you the basic accounting functions for freelancers and entrepreneurs. Unlimited invoice, expense tracking, and simple reports. But it’s short on advanced features like automated bank transaction imports and live customer support.

Pro Plan: Pro Plan: At $16 per business per month, the Pro Plan includes everything in the Starter Plan along with extras such as automatic bank transfer imports, receipt scanning, and priority support. This is the plan for growing companies looking for more automation and help with finance processes. Both plans sync well with Wave’s set of financial products like invoicing and receipt scanning.

Mobile Receipts: The plan is $8 per month or $72 when billed annually. It lets you view expenses all in one place, and tax season can be easy with the right books and reports. You also have unlimited receipt scanning and you can import 10 receipts at a time. You can also choose the pro plan for $170 annually, where you get everything in the Receipt plan plus auto-import bank transactions, auto-merge and categorize bank transactions, automate late payment reminders, add attachments to invoices and estimates, create reusable message templates and more.

Hire a Bookkeeper: Users can hire a bokkeeper from $149/month.

Digitally capture unlimited receipts: Its $8/month or $72/year on the starter plan, while it is included in the pro plan.

Payroll Pricing

Tax Service States: Tax Service States: $40/month base fee plus $6/employee or contractor per month. It includes automatic federal, state and local tax filing. This plan is great for companies in states where Wave Payroll will seamlessly handle taxes. Automation in such states takes a lot of administrative effort away.

Self-Service States: Self-Service States: $20/month base charge + $6/employee or contractor per month. The tax filings are still needed to be filed manually, which is more appropriate for those companies who already have payroll capabilities in house. If you are a business that is used to filing manually, then this plan offers a very economical solution.

Wave Payroll has a 30-day no-obligation trial period so you can try the platform for free. The free trial period is a great time to try it out and see what it has to offer and whether it’s right for your business. It’s priced competitively for small companies but lacks some of the ancillary functions that can be found in large payroll systems and may require additional software as businesses scale.

How does it compare to its closest competitors

| Feature/Plan | Gusto (Simple) | Wave Payroll (Tax Service) | QuickBooks Payroll (Core + simple start) | Patriot Payroll (Full Service) |

|---|---|---|---|---|

| Monthly Cost (Base) | $40 | $40 | $42.50 | $18.50 |

| Per Employee/Contractor | $6 | $6 | $6 | $2.50 |

| Automated Tax Filing | Yes | Yes (14 states) | Yes | Yes |

| Employee Self-Service | Yes | Yes | Yes | Yes |

| State Tax Compliance | Yes | Limited | Yes | Yes |

Key Features

Wave Payroll comes with different capabilities that will make payroll simple for small companies. These are great features for entrepreneurs who want to cut back on time and paperwork.

| Feature | Description |

| Payroll Processing | Automatically calculates wages, taxes, and deductions for employees and contractors. |

| Automated Tax Filing | Files federal, state, and local taxes on your behalf (only in 14 U.S. states). |

| Direct Deposit | Offers timely and secure payment options for employees and contractors. |

| Employee Self-Service | Employees can access pay stubs, tax forms, and update personal information via the portal. |

| Payroll Reminders | Notifications for upcoming payroll deadlines and tax filings. |

| Year-End Tax Forms | Prepares W-2s and 1099s for employees and contractors. |

| Integration with Wave | Syncs seamlessly with Wave’s free accounting software. |

| Compliance Assistance | Ensures that payroll operations adhere to local regulations in supported states. |

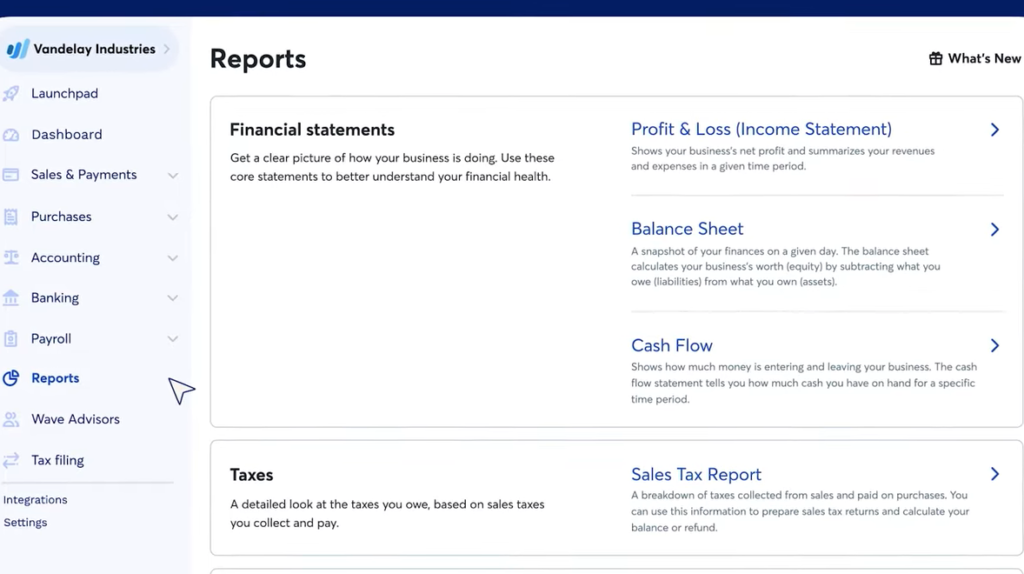

User interface

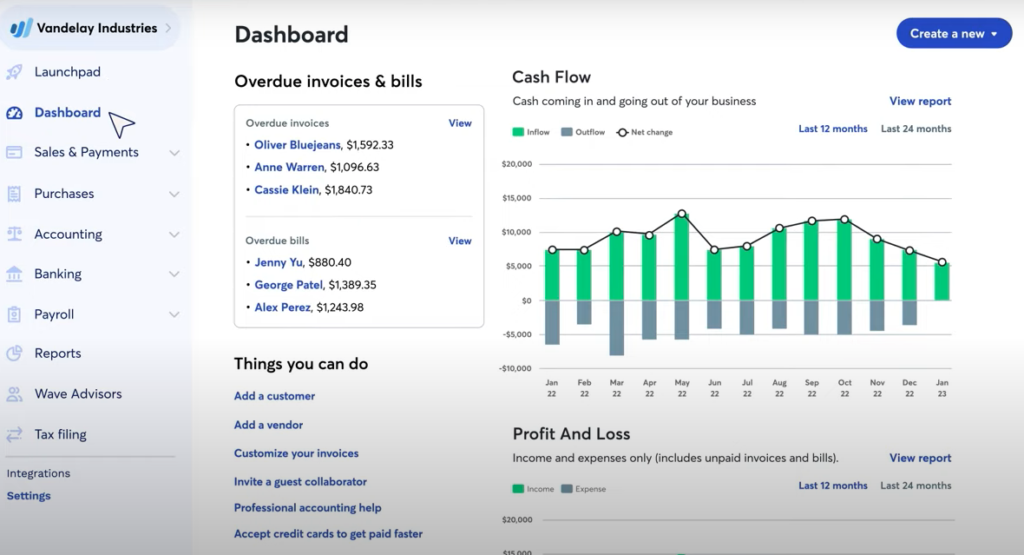

Wave’s UI and dashboard are easy to use and help small business owners enjoy a seamless experience. The dashboard is the hub where you can see a real-time summary of all the financial indicators including cash flow, P&L report, and late invoices. This app is categorized with a simple sidebar menu that makes accounting, invoicing, payroll, and reports very accessible.

(Source: Wave)

The interface prioritizes simplicity, making it accessible for users without extensive accounting knowledge. Interactive widgets and visual summaries, such as income and expense breakdowns, provide clarity and actionable insights. Transactions from linked bank accounts, invoices, and receipts sync automatically, ensuring real-time updates. Additionally, the responsive design ensures a seamless experience across both desktop and mobile devices.

This is a simple interface that will be accessible even to someone who doesn’t have much accounting experience. Slideshow widgets and graphic summaries (eg income and expense breakdown) make things easy to understand and apply. Automatic sync of bank transactions, invoices, and receipts across connected bank accounts ensures its always up to date. The responsive design allows it to operate on desktop and mobile devices with little to no lags.

The dashboard works really well for most small businesses, but the dashboard isn’t that customizable or the visualizations are not very enticing for more experienced users or big companies. Overall Wave’s dashboard is an efficient and easy to use finance solution.

Payroll Processing

Wave Automatic Payroll is an all-in-one payroll solution for small businesses. Through automating important steps, it cuts back on administration and helps comply with tax laws so that owners can concentrate on growth. It takes care of your payroll taxes as well, it calculates, files, and pays federal, state, and local taxes in full and on timely fashion. It also allows for the payment of salaries to employees and contractors through direct deposit — no more physical checks.

(Source: Wave)

With its recurring payroll option, companies can set automated cycles where pay is made without any work. — Employees have a self-service portal that allows them to view pay stubs, taxes and more so they don’t have to do much admin work. Wave Automatic Payroll also follows all tax legislation updates so that your are always in compliance, and you can access reports to track expenses and prepare for audits.

(Source: Wave)

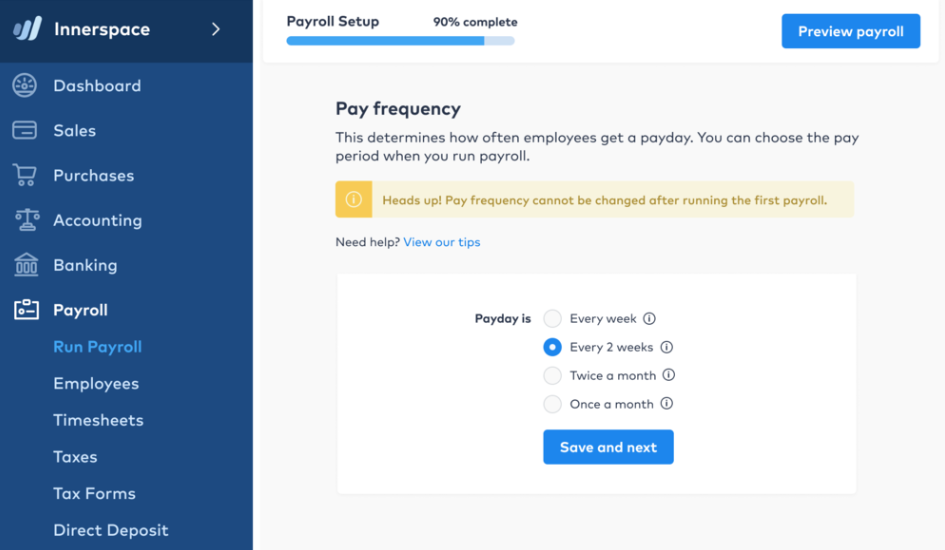

Wave Payroll streamlines the payroll process with the automatic calculation of wages, taxes and deductions. It supports hourly and salaried employees, it guarantees correct pay every time. Direct deposit pays on time, which is convenient for employers and employees alike.

It also supports various payment periods like weekly, biweekly, and monthly payments so the businesses can customize payroll runs as they require. Also, Wave Payroll will provide you with a complete summary of payroll expenses which can be exported for tax or accounting purposes.

(Source: Wave)

Its integration with Wave Accounting, is one of its better features. This means your payroll costs get reconciled to your accounting information so there is no data entry and errors. This is especially handy around tax season, because it keeps all of your financial records on one place.

Wave Payroll has powerful capabilities for contractor payments as well. It’s also different from competitors, in that you can distinguish between contractors and employees so you can report accurately for both of them on tax forms.

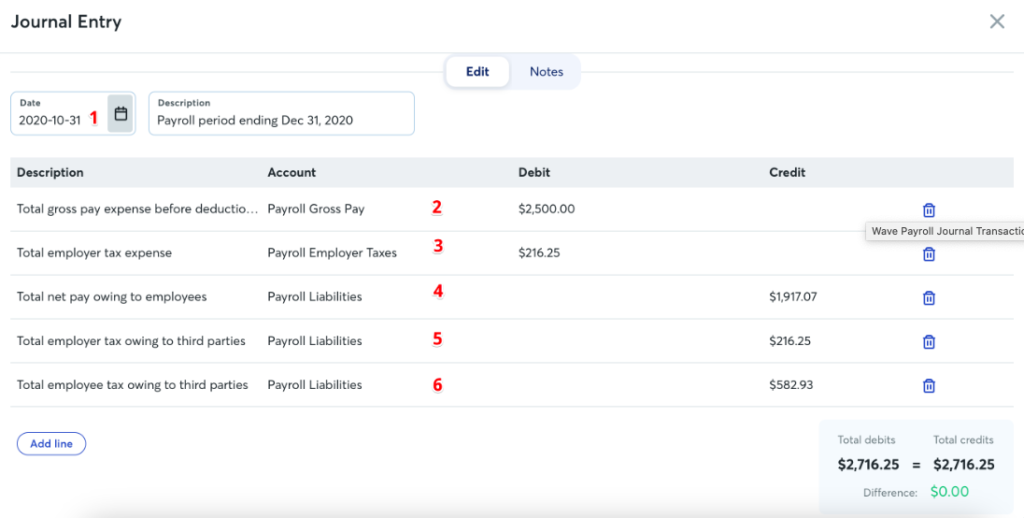

Wave records a journal transaction whenever you approve a payroll. It keeps track of every payroll expense, and how much money you owe to people (like your employees and the tax department). This is what a typical payroll journal transaction looks like (Source: Wave)

Potential Drawbacks

The processing speed of Wave Payroll is fast but not unlimited. It doesn’t support payroll-oriented functionality such as time tracking or benefits management, for instance. Another downside is that businesses outside the U.S. and Canada cannot use this platform. Those constraints make it less optimal for multi-national and cross-national enterprises.

Double Entry Accounting

Wave double-entry accounting gives small businesses a fast and accurate record-keeping system that follows the universal accounting truism that every move affects two or more accounts, leaving the equation equal: Assets = Liabilities + Equity. The entire process is automatically tracked with debit/credit entries so the books never become imbalanced and mistakes are minimized.

It also divides the transaction into account (i.e income, expense, assets, liabilities, etc.) it provides a tidy financial view. It’s integrated with bank accounts and payroll automatically so you save time and stay on top of your data. Wave’s double-entry accounting also creates vital financial statements, such as balance sheets and income statements, that give small business owners concrete data on how their business is doing.

By automating the important tasks and converting it to professional accounting practices, Wave makes bookkeeping easier, more accurate, and audit-ready.

Receipt Management

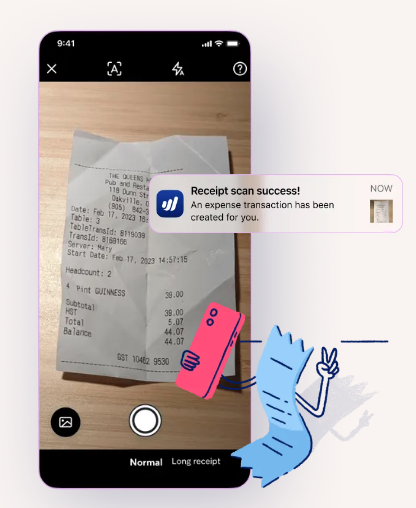

Wave’s receipt management feature simplifies expense tracking by allowing users to upload, organize, and store receipts directly within the platform. Using the Wave mobile app or desktop interface, users can capture receipts by snapping a photo or uploading files, ensuring all expenses are digitally recorded and easily accessible. The system automatically extracts key details like date, amount, and merchant information, categorizing expenses into the appropriate accounts.

Wave’s receipt module helps you keep track of expenses by letting you upload, arrange and store receipts in Wave directly. With Wave’s mobile or desktop app, you can take pictures of the receipts or upload files to have all the expense digitally saved and in one place. The software pulls out important details such as date, amount and merchant info, and sorts expenses into the proper accounts.

(Source: Wave)

This feature integrates seamlessly with Wave’s accounting tools, ensuring that recorded receipts align with financial reports and bank transactions, eliminating the need for manual entry. Users can also attach receipts to specific transactions, making audits or financial reviews straightforward.

This capability works in tandem with Wave’s accounting tools so the receipts you record match up with financial statements and bank transactions without you ever having to enter information manually. You can even associate receipts with certain purchases, making audits or financial analysis easy.

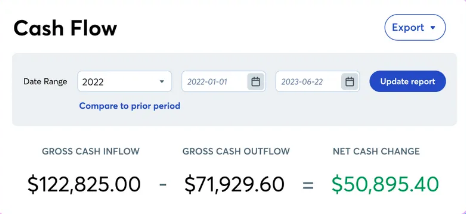

Reports and Analysis

Wave’s financial reporting and analytics gives small businesses everything they need to track and understand their financial performance. The software produces reports — balance sheets, income statements, and cash flow statements — that give you an in-depth understanding of a company’s financial condition. These are live and automatically updated as transactions happen to give accurate and real-time reports.

(Source: Wave)

Analytics are used to track revenue, expenses, and profitability trends that can be used to detect trends and improve on. The different filters allow businesses to choose between time-ranges or accounts, giving them the report that suits their needs. Additionally, the organized and easy to understand way in which data is presented is also great for owners of companies to analyze results and make informed decisions.

Potential Drawbacks

Wave’s reporting and analytics section is very intuitive, but limited. The reports are simple to use and great for routine tracking, but they don’t provide deep customizations or advanced analytics which might make them less suitable for companies with complicated or special financial requirements. It also lacks consolidation reporting which isn’t an ideal solution for enterprises with multiple entities.

Wave’s reports also relies on clean data entry, transactions can get classified or omitted which can lead to errors and must then be corrected manually. Also, since Wave is an integrated platform, it can be limited for enterprises that need more sophisticated external finance integration. Even though it has some limitations Wave’s reporting system is still a good option for small companies with straightforward financial needs.

Automated Tax Filing

Wave Payroll files and pays taxes automatically for businesses in 14 U.S states that are compliant with federal and state laws. This capability saves you from the hassle of being on time or doing some calculation manually.

Tax filing is easy with Wave Payroll. After you’ve supplied the proper employee data and wages, the software determines tax due and files it for you. You’ll be notified when filings are done and have that comfort in knowing you were taken care of.

Wave also offers quarterly and annual tax filing summary that can be emailed to accountants or internal audited. That visibility means companies can track their compliance in real-time.

Potential Drawbacks

If you live in a state where taxes aren’t automatically filed, you have to do it manually. That can be a big downer for companies without in-house payroll experience. Besides, Wave Payroll is not global tax compliant which is an additional pain for any organization with global employees.

Employee Self-Service Portal

Employees can get access to their pay stubs and tax returns on Wave Payroll’s self-service portal. They can even amend their personal information (direct deposit information, for example) making the administrative burden on employers smaller. This is a transparency feature that allows employees to manage their financial accounts.

Employees can easily access the information they require because of the portal’s ease of use. Employers also save time as staff won’t have to ask you so many payroll-related questions.

Wave’s self-service portal is also multi-device accessible — employees can access it on desktop, tablet or mobile device. This availability is especially helpful for a remote team or companies with mobile employees.

Potential Drawbacks

This is all well and good but the employee portal is not customizable in a sophisticated way to schedule PTO or manage benefits. This means that it’s not ideal for more demanding HR needs of companies. Besides, if you have employees working from overseas or in a remote area and they need something more than what the portal currently supports.

Integration with Wave Accounting

Wave Payroll seamlessly integrates with Wave Accounting for one system for payroll, invoicing, and accounting. This is especially beneficial for small business that is looking for an affordable, all-in-one. The integration eliminates the risk of making mistakes and simplifies accounting so that entrepreneurs can concentrate on expanding.

Wave Payroll combines payroll and accounting data, which gives businesses accurate information on labor costs, which allows them to find patterns and make decisions based on that information. It also offers historical data analysis which helps users monitor payroll over time.

Business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends (Source: Wave)

Potential Drawbacks

The integration is a plus but there are no third-party app integrations, so Wave Payroll can’t scale well for companies that grow and need more powerful tools. This can be limiting for companies that use their own project management or time tracking applications, for instance.

Mobile App

Wave Payroll has a mobile application so you can handle payroll while on the go. The interface of the app is basic and is the same as for desktop, making it look and feel the same. This mobility comes in very handy to business owners who want to take care of payroll when traveling or working at home.

The app let you approve payroll runs, review employee data, and run payroll reports. Alerts notify employees of deadlines to keep up with payroll tasks.

Multi-factor authentication is also supported by the app which is an additional security measure to ensure that confidential payroll information is secure.

Potential Drawbacks

There are some functions that are excluded from the mobile app, like generating detailed reports or access year-end tax documents. Also, you will need to have internet access as there is no offline mode. These limitations might not be a great convenience for users that need all functions while traveling.

Customer Support

| Support Feature | Availability |

|---|---|

| Email Support | Available for all users, providing timely responses to queries. |

| Chat Support | Accessible during business hours for real-time assistance with platform-related issues. |

| Knowledge Base | A comprehensive repository of guides, FAQs, and tutorials for self-help solutions. |

| Community Forum | Enables users to discuss common issues and share tips with other Wave users. |

| Webinars and Training | Periodic live training sessions and webinars to educate users on platform features and updates. |

| Phone Support | Not available, which could be limiting for users requiring urgent or detailed troubleshooting help. |

Wave Payroll’s support is prompt and friendly, but the fact that there’s no phone support is a bummer for users with quick issues. The knowledge base is equipped with walk-through guides and video tutorials so that users can find solutions by themselves.

Wave organizes occasional webinars and live training, which give the users additional tools to understand the platform’s functionality.

Customer Reviews

Wave Payroll gets excellent feedback on price, ease of use, and integration with Wave Accounting. Small entrepreneurs love that it is easy to use and they also appreciate the automation features. But some users complain of limited tax-filing resources and no fancy HR features. They have also expressed concerns about the lack of direct customer support channels, such as phone support However, these disadvantages are few and many still consider it useful for managing payrolls.

How does the biggest review sites rate Wave

- TrustRadius: 6.8 out of 10

- G2: 4.3 out of 5 stars

- Capterra: 4.4 out of 5 stars

- GetApp: 4.4 out of 5 stars

Positive feedback from different review sites

“Wave offers fantastic flexibility and affordability for small business accounting. It’s easy to use, and I only pay for specific payment features.”

— Surjya N. (Techjockey)

“As a freelancer, I rely on Wave to send invoices, track payment statuses, and keep all my earnings organized for tax season. It provides everything I need in one place.”

— Anonymous User, (Capterra)

“Wave is an easy-to-use accounting software. Even people who are not accountants, like myself, can use it. I am a small business owner who does his accounting. The best part is – Wave offers the option to run multiple businesses through the same account.”

— Anonymous User, (Capterra)

“I use the free version and am completely happy with it! I am not an accountant, so my learning curve was big, but that was more for the accounting side and not the software side.”

— Mary T. (Capterra)

“It is easy to use. It is very inexpensive too… Most features are for free…”

— Janelle J. (Capterra)

“Wave has fulfilled our needs for an affordable solution for our two subsidiaries. It makes billing and invoices easy.”

— Nandini L, (Techjockey)

“Setting up Wave was straightforward and initially easy to understand.”

— Babita, (Techjockey)

“Wave simplifies recurring billing and saves customer information for easy invoicing. It also allows to adjust the pricing for particular product and services.”

— Varsha Sharma, (Techjockey)

Negative feedback from different review sites

“Wave seems to be down more than it is up. The last few weeks it has been under repair very often making it very hard to do business.”

— Marc F, (TrustRadius)

“The reporting side is very limited, only basic reports are available.”

— Daniel J, (Capterra)

“Users will have difficulty running off-cycle payrolls.”

— (The SMB Guide)

“There is no phone support.”

— (The SMB Guide)

“Wave Payroll’s full-service payroll plan is only available in 14 states.”

— (CertOnce)

“Wave doesn’t handle reimbursements or garnishments.”

— The SMB Guide

“The site cannot handle multiple pay rates or flexible payroll scheduling.”

— The SMB Guide

Keep in mind, that whatever negative experiences you may have had with Wave software typically aren’t permanent, as the company does take user reviews seriously and use them to enhance their products. The platform, for instance, has rolled out automatic bookkeeping functions, including transaction classification and merging duplicates, according to user input.

Conclusion

Wave Payroll is a great option for small companies looking for a simple and cost-effective payroll system that can work with accounting software. Automated payroll, employee portal, and direct deposit options all make it easy for small teams to run their own payroll.

However, businesses requiring advanced HR features, extensive customization, or international payroll support may need to explore alternative platforms. By understanding its strengths and limitations, you can determine whether Wave Payroll aligns with your business needs.

Who is Wave Payroll most suitable for…

- Small businesses with straightforward payroll needs

- Companies with US offices in states with automated tax filing.

- Users of Wave Accounting seeking a unified financial solution

Who is Wave Payroll not as suitable for…

- Corporations outside the U.S. and Canada

- Companies who need high-end HR software or a more sophisticated reporting platform.

- Enterprises with large teams and complex payroll needs

If you are not sure if Wave is the right fit for your company check out our review of Gusto here