Written by: Tom Smith

In this Rippling vs Deel 2024 Comparison: Which is better? we compare Rippling and Deel, two companies specializing in HR and payroll automation for businesses. We’ll delve into their HR and payroll features, automation offerings and customer support to help you pin down which HR and payroll solution is the best fit for your business.

Pros and Cons

| Feature | Rippling (Pros) | Rippling (Cons) | Deel (Pros) | Deel (Cons) |

| Payroll Processing | – Automated payroll, tax filings, and reports. Flexible pay cycles and direct deposit options. | – Can be complex for users unfamiliar with payroll software. | – Comprehensive payroll services managed by experts. Includes tax filing and compliance. | – Less control over payroll details due to outsourced model. |

| Automation & Ease of Use | – High level of automation for payroll and HR tasks. User-friendly interface and mobile app. | – Initial setup and customization may require more effort. | – Simplified processes through co-employment model. Direct support for setup and management. | – Potentially less flexibility in software customization. |

| HR Integration | Seamless integration: works with all your HR functions like onboarding and benefits. – Wide breadth of HR tools and integrations. | – Requires managing multiple modules within the platform. | – Integrated HR services, including risk management and compliance. Hands-off HR administration for employers. | – May offer less choice in HR vendors and solutions. |

| Benefits Management | – Comprehensive benefits administration with flexibility in providers. Easy setup and management for employees. | – Choices can overwhelm small businesses without dedicated HR. | – Full-service benefits management with expert consultation. Simplified employee enrollment process. | – Limited customization of benefits packages based on PEO offerings. |

| Compliance & Security | – Strong security measures and compliance tools. Regular updates to stay compliant with regulations. | – Businesses must actively manage and monitor compliance settings. | – Outsourced compliance and risk management. Professional handling of complex legal and tax issues. | – Dependence on Deel compliance strategies and protocols. |

| Customer Support | – Extensive online resources and community forums. Multiple channels for direct support. | – May experience variability in support response times. | – Personalized support through dedicated account managers. Direct and tailored assistance. | – Fewer self-service and online support resources. |

Comparison Table

| Key Features | Rippling | Deel |

| Comprehensive Online Help Center | Yes | No |

| Direct Access to Customer Service (Email, Phone, Live Chat) | Yes | Yes |

| Community Forum | Yes | No |

| Dedicated Account Managers | No | Yes |

| Personalized Account Management | No | Yes |

| Tech-Forward, Innovative Solutions | Yes | No |

| Traditional, Hands-On Support Approach | No | Yes |

| Starting price | $8 per employee | Free |

| Benefits administration | Yes | Yes |

| Global payroll | Yes | Yes |

| Mobile app | Yes | No |

Additional Core Functionalities of Rippling

- Recruitment and onboarding

- Automated employee onboarding

- Direct management of employee devices

- Full service payroll

- Time and attendance

- Flex benefits

- Applicant tracking

- Learning management

- HR support

- PEO services

Additional Core Functionalities of Deel

- Compliance and tax document collection

- Localized contract generation for international hires

- Employee self-service portal

- Automatic invoicing and payments

- Benefits and insurance management

- Real-time expense approvals

- Work permit and visa processing assistance

- Advanced analytics and reporting tools

- Runs payroll in more than 100 countries.

- Deel offers immigration and visa assistance across 25 countries.

Pricing Comparison

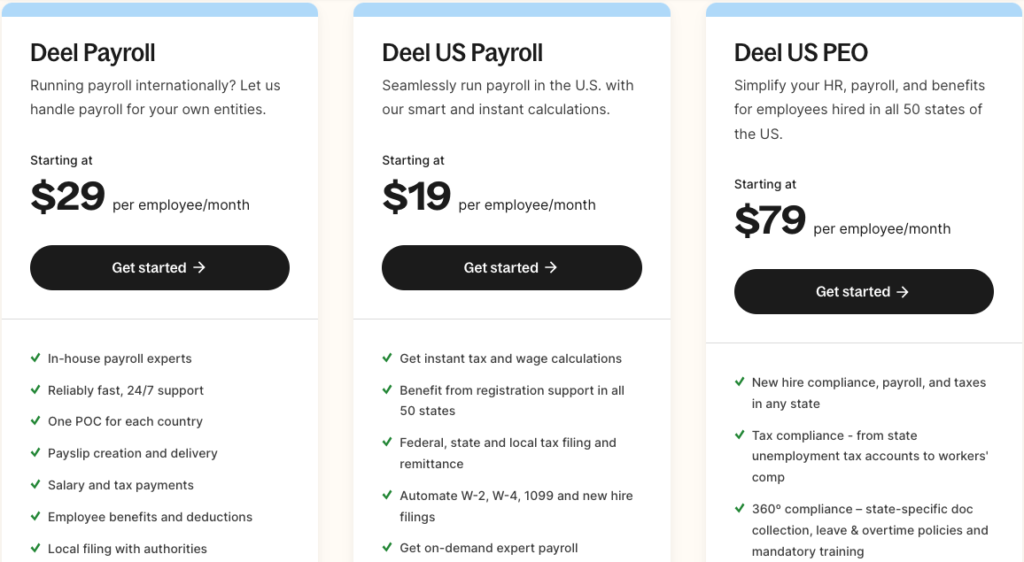

Deel pricing

Deel’s pricing is straightforward: there are a fixed number of tiers for each kind of contractor management as well as EOR services. Their contractor management free plan lets businesses experiment with a small number of contractors and scale up from there.

Contractor Plan: for businesses that hire freelancers and contractors globally, focusing on compliance and payments. From $49 per month.

EOR (Employer of Record): Useful for any company hiring abroad who doesn’t want to register a separate legal entity, with Deel taking care of the employer compliance, payroll and benefit administration side. $599 per month ($499 yearly).

Global Payroll and US Payroll: Deel’s pricing for both global and U.S. payroll services is competitive compared to its closest rivals, offering a variety of features and flexibility.

Deel HR

The Deel HR plan is free to use for teams of up to 200 people – you can also request a custom quote for being a larger company. Deel HR’s advanced features include expense management, workflow automation and HR reporting. It also helps complete common HR tasks like onboarding, document collecting, ordering equipment and processing PTO requests.

Deel Engage

Starts at $20 per employee/month and includes different features that drive performance, growth and engagement. You can build your own courses easily via drag-and-drop, ad quizzes, surveys and tasks. Create and manage goals for individuals, teams and company, create career pathing frameworks for every role and level, run highly customized 360° feedback reviews, use AI to draft in-depth frameworks in minutes and more.

Each plan level includes a set of services according to different international hiring and payroll needs, with clear pricing structures that may include base fees plus PEPM charges, depending on the services you choose.

Rippling pricing

The Rippling Unity package is $8 per user, per month. Four different plans are available on Rippling Unity, but specific pricing information for these isn’t publicly available. Instead, you need to set up a demo with Rippling before you’re given a quote. Also, the monthly fee given above is for the base price – your price might be different depending on which HR Cloud, IT Cloud, and Finance Cloud products are included in your plan.

Key Feature Comparison

Payroll processing capabilities

For a clearer comparison in the conclusion, let us delve deeper into the payroll processing abilities of Rippling and Deel based on factors such as pay cycle flexibility, direct deposit and tax filing services.

Pay Cycle Flexibility

- Rippling stands apart from other companies because its pay period offerings are quite extensive. It allows companies to take advantage of weekly, bi-weekly, semi-monthly and monthly payroll schedules for their businesses. Companies that hire professionals on different kinds of contracts will need to consider carefully what pay period works best with the types of employees they hire.

- Deel Importantly, Deel enables a number of different pay cycle options, so some flexibility is included. However, Deel’s largely PEO model also leads to a more consistent workflow – whereas there is flexibility, there may also be constraints based on the PEO risk-pool and blanket offerings. For companies with more unique or specific pay cycle needs, this model may not be as flexible as Rippling.

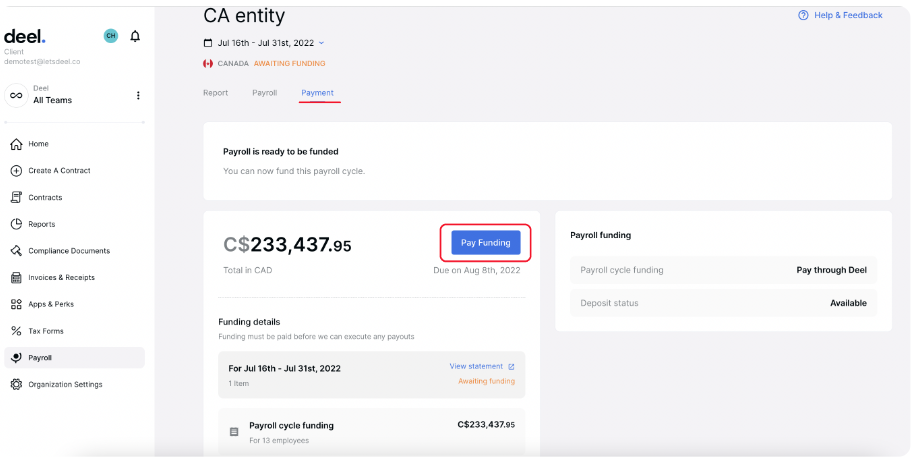

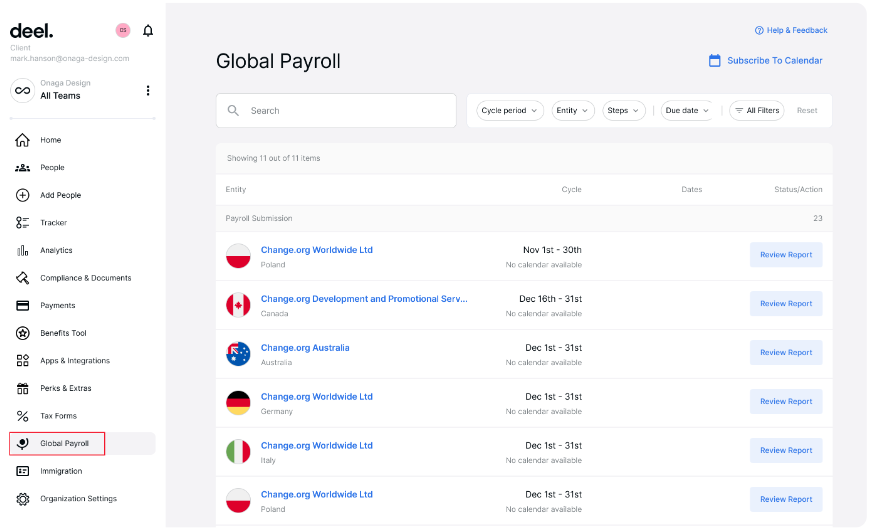

Deel payroll (Source: Deel)

Direct Deposit

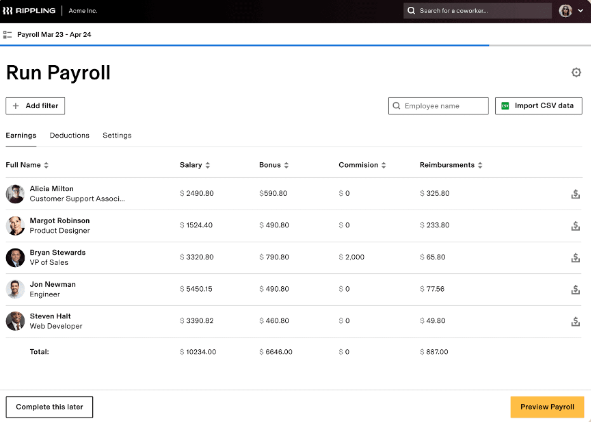

- Rippling Not only does Rippling offer direct deposit – it can guarantee it; payroll can be run in 90 seconds. Because payments clear instantly, this is of particular benefit to anyone – employees or employers – who appreciates speed. And since fast payroll means faster payroll adjustments, it also appeals to anyone who needs to work fast.

- Deel While Deel provides direct deposit as an option with payroll, the timing can be slower than the quick-pay direct deposit available through Rippling, often taking two to three business days before employees have access to their funds. While Deel is reliable, it doesn’t necessarily provide the same expedited direct deposit options.

With Rippling you can run payroll in 90 seconds (Source: Rippling)

Tax Filing Services

- Rippling automates ‘all of the HR, tax filings and reporting required by federal, state and local laws’. This means that Rippling manages the ‘complexities of payroll taxes’ (including automatic updates to tax codes) in a way that can reduce the administrative burden on each business.

- Deel Through its co-employment model, Deel partners with businesses on tax filing and compliance, a process for which businesses are normally solely responsible. Deel handles the payroll faster, and can make sure that all the paperwork pertaining to tax filing is correct and timely, thereby saving any hassle for the business. The benefit here is the calibre and assurance that comes from being part of a larger organisation that is processing payroll taxes for multiple clients.

Automation in Payroll Processing

- Rippling One of Rippling’s strengths is automation. The self-proclaimed ‘first truly integrated HR, IT, and payroll platform’ is so well integrated that it authenticates and remembers users state across its systems and can push live data from system to system. So, if you promote someone, enrol them in a new benefit, or change their address, their profile is updated automatically and there’s no extra effort required, beyond the initial entry.

- Rippling’s Workflow Automator is an intuitive, drag-and-drop no-code tool that automates processes by setting them into motion when custom criteria you define are met, both inside Rippling and with third-party applications. For example, upon a new hire’s start date, you might automatically create a Ninja coworker record, notify the employee’s team through Slack, and block off a spot on the company calendar.

- Rippling’s automated platform is geared towards the modern, tech-savvy business that wants to leave as little as possible to manual accounting and processing, from hours tracked, pay calculated and taxes filed to paychecks paid. The emergence of such fully automated systems turns out to be especially useful for businesses that want to keep overhead as small as possible so they can concentrate on strategic ends.

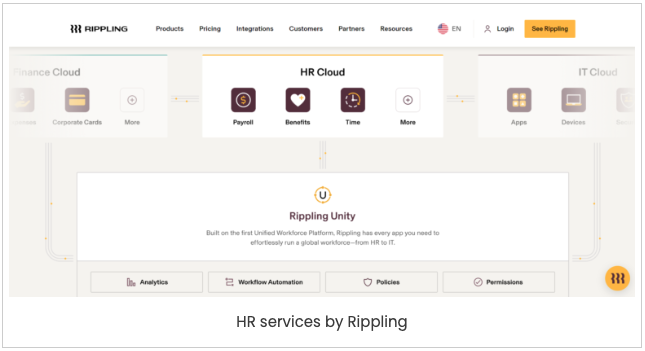

Rippling offers a platform that automates drippy chores – from employee onboarding to payroll processing, employee and contractor benefits, and device provisioning and controls like IT security (Source: Rippling)

Deel

- Deel Deel offers a payroll service as part of its Professional Employer Organization offering, which features a high level of automation in a number of areas, such as managing payroll compliance, tax filings and benefits. Automation here is designed to make sure that a firm is in compliance with any and all laws and regulations governing employment without requiring that the firm do so on its own.

- The arbitrage of Deel payroll services relies heavily on the PEO’s expertise and infrastructure, meaning that, while payroll and related services are highly automated, they might not be nearly as flexible and customizable as conventional SaaS platforms like Rippling. The emphasis in this model is on compliance, accuracy and taking the weight of the payroll management off of the shoulders of business owners.

Ease of Use

Rippling:

- Payroll might be complicated, but Rippling’s platform makes it simple. No matter their technical ability, users go through each step of the payroll process guided by intuitive tools and dashboards, which clearly represent how payroll data looks and when actions are required or when different data is ready for reporting.

- Users can also benefit from Rippling’s extensive knowledge base, live support and training sessions, all designed to resolve problems quickly or learn about the most effective way to use the system.

Deel

- The interface of Deel platform is user-friendly. This platform offers a payroll processing service, which specifically aimed at business who don’t have a complicated payroll or HR departments. The system can be easily navigated; payroll processing, reporting and managing employees are all enhanced to provide users an intuitive experience.

- As Deel is a full-service solution, this ease-of-use comes in large part from the PEO’s support and experience – employers are less configuring a tool and more delegating work to the PEO’s people to handle payroll and HR functions for you. This can mean a (slightly) less direct control overall over every payroll detail (like with Rippling above).

On your Global Payroll dashboard, you can see all your organizations, your payroll cycles, the latest status and additional information (Source: Deel)

When it comes to automation and ease of use in payroll processing, Deel and Rippling are tied in first place. Your perspective may differ depending on what your company values more. If an ultra-high level of automation, deep integration across HR and IT systems, and a modern, intuitive user interface are particularly important, then Rippling is the way to go, as this solution puts you in charge of your payroll, with as little manual involvement as possible.

Contrariwise, if your company needs end-to-end coverage and a payroll workflow that’s largely handled for you – i.e, compliance with pay rules is key – and you don’t need in-depth payroll admin because professional support is available – then Deel would be a better choice. It works well for businesses that prefer outsourcing payroll so they don’t have to involve themselves in the process closer than necessary (and payroll software becomes merely an interface between the business and its accounting).

The truth is, this issue is ultimately a business decision, dependent on the needs of the operational side of your business, and how much control you want to retain, also in addition to a consideration of how it fits with other business systems.

Final Thoughts

Ultimately, the choice between Rippling or Deel for payroll processing capabilities will depend on what your business needs and values. If you want lots of customization and direct deposit speed, Rippling likely has what you’re looking for and the flexibility to make it work for your business. Similarly, if your business wants top-quality support and coverage in tax filings, reimbursements and compliance work generally, then a PEO model, like Deel, might align with your comfort level.

Both of them offers different strengths, and selecting the right platform for your business should come down to which provider’s advantages fit best with your payroll needs and overall HR strategy.

Human Resources Integration

Rippling:

- Onboarding: This is one area where Rippling excels by automating and integrating the onboarding process with payroll and other HR functions. After filling out tax forms, direct deposit information, policy forms and other information required to onboard a new hire, employees can digital sign all of their onboarding paperwork, and that information automatically enters the payroll system without having to re-enter the data. New hires are ready to be paid from day one with little to no intervention by the employer.

- Benefits Administration: Rippling’s benefits administration platform, which is sold as an integrated offering with its payroll system, automatically updates payroll to reflect changes in employee benefits (for example, in the amount deducted or contributed toward health or retirement benefits). A dashboard that consolidates a company’s benefits and payroll data can then be accessed by managers via a single interface.

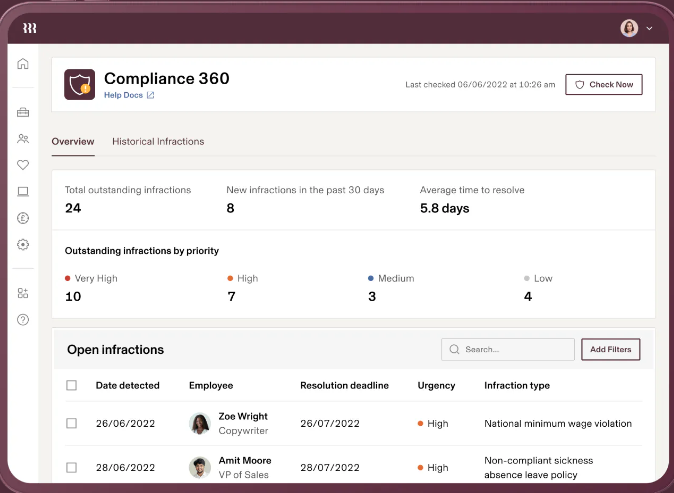

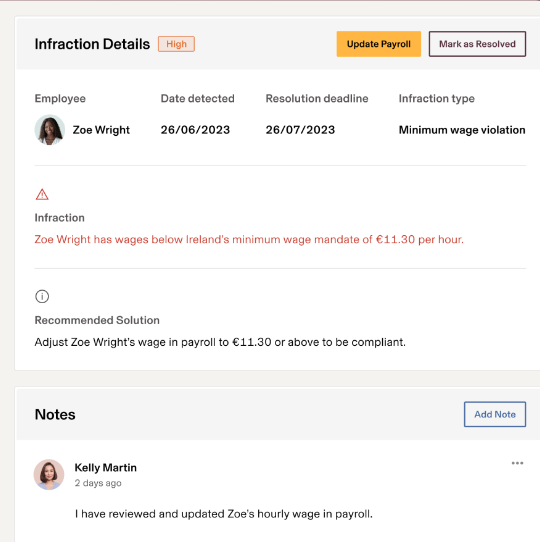

- Compliance Management: Compliance Management: A detailed compliance management system integrated with your other HR tools can be hard to keep track of, but Rippling helps you through automation and integration: the platform monitors all compliancy requirements (eg tax filings, required new hire reporting, labour law compliance), it updates automatically based on current compliancy regulations, reducing the risk of compliance violations and associated penalties.

Deel:

- Onboarding: Onboarding: Deel also handles onboarding documentation via its integrated HR and payroll services, providing an all-in-one experience for the new hires. Deel shoulders an important part of the onboarding process for the employer or the employee, such as collecting and documenting the onboarding information, taking care of compliance, and setting up payroll for the new hires. By being integrated, the onboarding process isn’t only more efficient, but it’s also fully compliant with relevant laws and regulations, and leads to better HR management as a result of the expertise it provides.

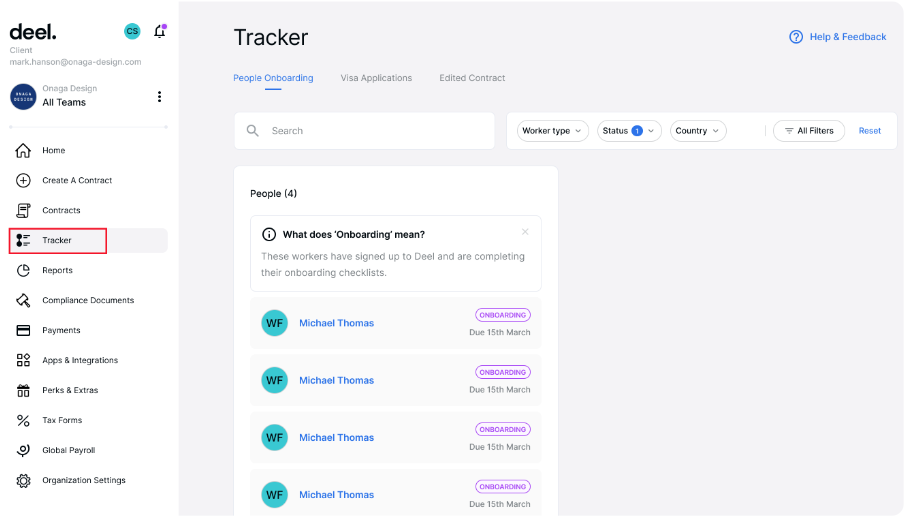

Deel can help you keep track of whether your employee or contractor has completed their onboarding process. You just need to go to the Tracker tab on the Home page to see their progress in onboarding (you can also identify which input are pending on their onboarding checklists) (Source: Deel)

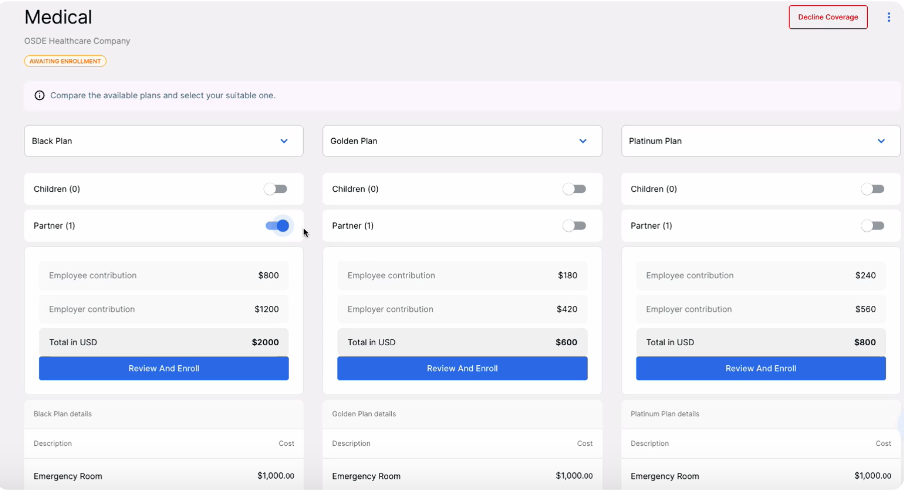

- Benefits Administration: When employees use Deel to enrol in benefits, those contributions and appropriate deductions flow into payroll as part of an integrated administrative system, ensuring compliance and proper legal record-keeping. The advantage for employers is the ability to provide more comprehensive, often enterprise-level benefits that can be efficiently managed alongside payrolls, due to the economies of scale and negotiating power that PEOs have.

- Compliance Management: Compliance management is an area where Deel shines, at least in large part because of the nature of PEO services. Deel becomes a co-employer and thus assumes the majority of employment compliance obligations – for example, all payroll taxes, workers’ compensation insurance for the employees, and management of all areas of employment law as an employer. This alignment means that businesses are less likely to run into compliance issues with the system in place and the expertise needed to keep them in check.

Final Thoughts

When it comes to integration of HR features, which is better really boils down to how much resource a business wants to take away from organic, hands-on HR. Because Rippling offers complete business automation for HR and payroll functions, it will appeal to businesses that prefer tighter control of these valuable human-capital functions.

In the meantime, Deel provides a comprehensive, albeit less customizable, solution harnessing the advantages of the PEO model, and is more suitable for companies looking for a one-stop shop solution that places the administrative work of HR and payroll on the hands of the provider, to take advantage of its infrastructure and compliance-, benefits- and onboarding-related know-how.

In the end, your pick between Rippling and Deel for HR integration should follow from your business’s strategic goals, the degree of control you want when it comes to HR processes, and your preference for automation versus expert management.

Benefits Management Features

Rippling:

Rippling provides health, dental and vision insurance; retirement benefits; and a host of ancillary benefits such as gym membership and commuter benefits, all of which employers can tailor to meet the needs of their workforce.

Rippling makes it easy for you to set up and manage benefits. It is easy to add or change benefit plans using their online software. Benefits are selected online, the employee sees their contributions in real time, and changes in benefits show up in payroll deductions automatically.

(Source: Rippling)

Deel:

Range of benefits: Deel provides a fat benefits package including health, welfare, retirement savings plans, ancillary benefits such as life and disability insurance, Deel gives access to high end benefits at a fear price. This is because Deel pools employees from a variety of employers that better allows them to negotiate better pricing with providers.

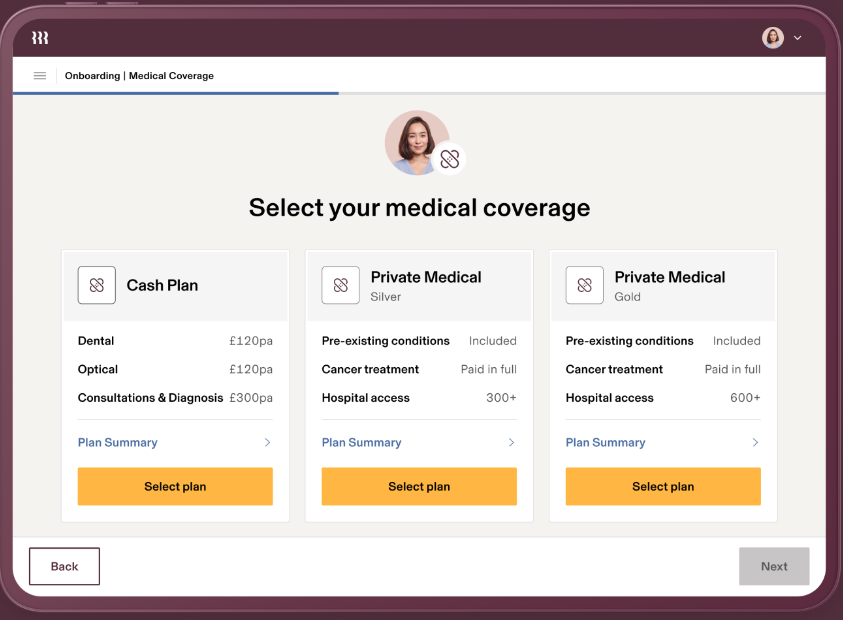

User Experience (setup and management): Deel does most of the legwork for your employees, from negotiating with insurers to facilitating enrolment windows to compliance with various regulations. Employees can enrol through a portal, and Deel will set up the benefits the company has chosen for them, but this is ultimately less flexible than a platform like Rippling where the worker has more control over the benefits they choose and how they enrol. Still, it makes setup and management easier, saving employers and employees a lot of work.

You can choose from multiple tiers and insurance plans on Deels platform (Source: Deel)

Employer and Employee Perspectives

Rippling:

A big strength of Rippling’s platform is how easy it makes it for employers to design benefits packages tailored to their employees. This is because Rippling integrates with payroll and HR systems so that employers can easily make changes to benefits as their company grows or its needs change.

Rippling’s user-friendly enrolment experience launches employees to a menu that allows them to look at different benefit options, make informed choices, and calculate salary deductions based on their preferences in real time.

Deel:

Employer benefits: Deel’s broad, bundled benefits package makes it easy to avoid the hassle of having to navigate a complex array of benefits. While options for customization are more limited, the simple set-up process and quality benefits package make up for this in many ways.

Employee view: Employees must pick their benefits from a curated list provided by Deel. While the list might be less flexible than some platforms (as with Rippling), it also comes with less expensive pricing for premium options. The enrollment process is simplified but cuts out some choices for employees.

It may come down to how much you want to customize a benefits package compared with what one might get from a scalable benefits management solution with a set menu. Rippling basically leaves the work to you with more flexibility, while Deel offers a more plug-and-play, hands-off solution, with the rationale that negotiated competitive benefits packages can usually be procured for a bigger employee pool, larger budget and more clout.

It will largely come down to how much your organization and its employees need from a system such as this, as well as your flexibility in terms of benefits plan and the time and resources you can dedicate to benefits administration.

Compliance and Security

When it comes to compliance and security, what’s better – Rippling or Deel? For tax compliance, Rippling provides an automated ‘out of the box’ solution, ensuring correctly withhold taxes and file tax forms and returns, and that employees are paid within compliance limits. It’s also highly secure: they encrypt communications both in transit and at rest, and use multi-factor authentication in compliance with privacy laws such as GDPR and CCPA.

With Deel, these issues are outsourced to the company, which manages them for you. It does this with high-end encryption and strict privacy policies consistent with the requirements of global data-protection regulation. The question, then, is whether you would rather manage your own compliance and security (as an HR and security function) with Rippling’s tools – reflecting the operational focus of your business – or outsource to Deel so it can manage compliance and security across your global workforce – reflecting the compliance risk of your business.

(Source: Rippling)

Rippling automatically detects unnoticed compliance violations and suggests a corrective strategy for each (Source: Rippling)

Customer Support

Both Deel and Rippling offer readymade and tailored resources and support for customer experience, though Deel’s support is more likely to be exchange-oriented, and Rippling’s more person-oriented. How this is provided makes a difference to a company’s experience with payroll, HR admin, and compliance.

Rippling received further recognition for its service where it stands apart because of its focus on technology as a means to customer support. The HR platform’s help centre provides multiple in-depth guides, regularly asked questions and tutorials to help users acquire new skills in navigating the platform successfully.

Rippling also made itself available for customer support through emails, live chat and phone to facilitate faster handling of issues and enquiries. Rippling also employed a community forum where users can offer tips, ask questions and share experiences, resulting in a supportive user community.

‘On the other hand,’ Deel takes a more traditional hands-on approach to customer support that reflects its PEO services, where clients get dedicated account managers as a single point of contact for all their questions – from payroll to compliance and any related inquiries. This allows businesses to avail bespoke support for all its operational needs.

While Deel also provides phone and email support, it’s the individualised nature of client interaction with an account manager that’s a differentiating factor of Deel’s customer service. Unlike Rippling, Deel might not have an equivalent amount of online tools such as help centres or forums that allow clients to interact with the system by themselves.

In conclusion, it all boils down to whether your business is comfortable with being reliant on a more self-reliant, tech-enabled support framework like Rippling, or if you prefer a more hands-on, personalised service like Deel. If your business values a leaf-like organizational structure that values independence and self-resolution of many queries, then Rippling is likely to be your best option.

However, if you prefer the stalk-like structure of an organisation that relies on a centralised HR mechanism and a team that’s readily available for constant contact and counselling, then Deel would be your optimal go-to.

Conclusion

If your priority is a single, unified system to handle everything from payroll to HR, benefits and IT management, and you value products you can configure instead of canned packages that demand complete overhauls of your processes, then we’re here. It doesn’t matter how large your company is, either. Anyone needing a flexible system that can scale quickly is likely to be a great fit for Rippling. In particular, as a one-stop shop for your organization, its a particularly good fit for fast-growing companies.

A company with global expansion ambitions who also has to deal with the hassles of maintaining an international payroll and keeping on top of compliance will be better served using Deel. Benefiting from its deep knowledge of different territories’ hiring and employment landscape, Deel provides employers with a simplified and compliant route to global workforce management, with full transparency on pricing and a free plan for contractors.

Overall, it’s the Rippling vs Deel debate you are up against, depending on your company’s goals and what you need it to achieve: Rippling if you want your dependencies between HR and IT to run seamlessly and more efficiently on a unified platform; Deel if you’re after compliant, painless international expansion. And the winner is … your business strategy and operational needs.

Read our review of Deel here if you want more information about the PEO, also check out our review of Rippling here